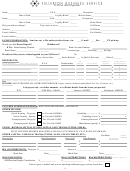

Self-Employment Tax Organizer Template

ADVERTISEMENT

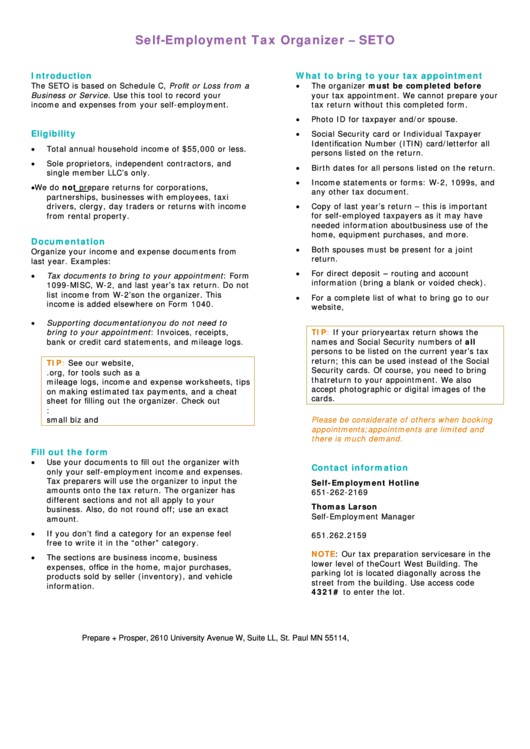

Self-Employment Tax Organizer – SETO

Introduction

What to bring to your tax appointment

The SETO is based on Schedule C, Profit or Loss from a

The organizer must be completed before

•

Business or Service. Use this tool to record your

your tax appointment. We cannot prepare your

income and expenses from your self-employment.

tax return without this completed form.

Photo ID for taxpayer and/or spouse.

•

Eligibility

•

Social Security card or Individual Taxpayer

Identification Number (ITIN) card/letter for all

•

Total annual household income of $55,000 or less.

persons listed on the return.

Sole proprietors, independent contractors, and

•

Birth dates for all persons listed on the return.

•

single member LLC’s only.

•

Income statements or forms: W-2, 1099s, and

We do not prepare returns for corporations,

•

any other tax document.

partnerships, businesses with employees, taxi

drivers, clergy, day traders or returns with income

•

Copy of last year’s return – this is important

from rental property.

for self-employed taxpayers as it may have

needed information about business use of the

home, equipment purchases, and more.

Documentation

•

Both spouses must be present for a joint

Organize your income and expense documents from

return.

last year. Examples:

•

For direct deposit – routing and account

Tax documents to bring to your appointment: Form

•

information (bring a blank or voided check).

1099-MISC, W-2, and last year’s tax return. Do not

list income from W-2’s on the organizer. This

•

For a complete list of what to bring go to our

income is added elsewhere on Form 1040.

website,

Supporting documentation you do not need to

•

TIP:

bring to your appointment: Invoices, receipts,

If your prior year tax return shows the

bank or credit card statements, and mileage logs.

names and Social Security numbers of all

persons to be listed on the current year’s tax

return; this can be used instead of the Social

TIP:

See our website,

Security cards. Of course, you need to bring

, for tools such as a

that return to your appointment. We also

mileage logs, income and expense worksheets, tips

accept photographic or digital images of the

on making estimated tax payments, and a cheat

cards.

sheet for filling out the organizer. Check out

irs.gov for useful tools and videos. Key words:

small biz and irsvideos.gov.

Please be considerate of others when booking

appointments; appointments are limited and

there is much demand.

Fill out the form

Use your documents to fill out the organizer with

•

Contact information

only your self-employment income and expenses.

Tax preparers will use the organizer to input the

Self-Employment Hotline

amounts onto the tax return. The organizer has

651-262-2169

different sections and not all apply to your

Thomas Larson

business. Also, do not round off; use an exact

Self-Employment Manager

amount.

If you don’t find a category for an expense feel

•

651.262.2159

free to write it in the “other” category.

NOTE: Our tax preparation services are in the

The sections are business income, business

•

lower level of the Court West Building. The

expenses, office in the home, major purchases,

parking lot is located diagonally across the

products sold by seller (inventory), and vehicle

street from the building. Use access code

information.

4321# to enter the lot.

Prepare + Prosper, 2610 University Avenue W, Suite LL, St. Paul MN 55114,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4