Form G-45/g-49 - Schedule Ge - General Excise/use Tax

ADVERTISEMENT

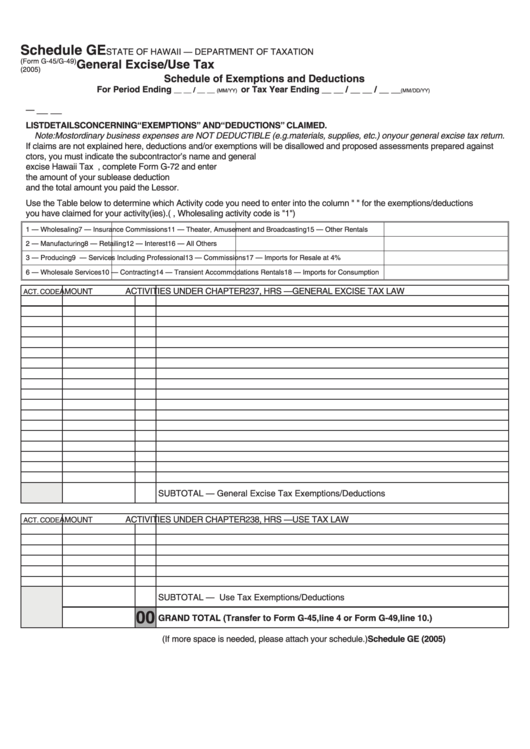

Schedule GE

STATE OF HAWAII — DEPARTMENT OF TAXATION

(Form G-45/G-49)

General Excise/Use Tax

(2005)

Schedule of Exemptions and Deductions

For Period Ending

or Tax Year Ending __ __ / __ __ / __ __

__ __ / __ __

(MM/YY)

(MM/DD/YY)

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __

__ __

—

LIST DETAILS CONCERNING “EXEMPTIONS” AND “DEDUCTIONS” CLAIMED.

Note: Most ordinary business expenses are NOT DEDUCTIBLE (e.g. materials, supplies, etc.) on your general excise tax return.

If claims are not explained here, deductions and/or exemptions will be disallowed and proposed assessments prepared against

you. If you are claiming a deduction for payments to subcontractors, you must indicate the subcontractor’s name and general

excise Hawaii Tax I.D. No. If claiming a deduction for certain leases and subleases of real property, complete Form G-72 and enter

the amount of your sublease deduction below. You must also list the name and general excise Hawaii Tax I.D. No. of the Lessor

and the total amount you paid the Lessor.

Use the Table below to determine which Activity code you need to enter into the column "Act. Code" for the exemptions/deductions

you have claimed for your activity(ies). (e.g., Wholesaling activity code is "1")

1 — Wholesaling

7 — Insurance Commissions

11 — Theater, Amusement and Broadcasting

15 — Other Rentals

2 — Manufacturing

8 — Retailing

12 — Interest

16 — All Others

3 — Producing

9 — Services Including Professional

13 — Commissions

17 — Imports for Resale at 4%

6 — Wholesale Services

10 — Contracting

14 — Transient Accommodations Rentals

18 — Imports for Consumption

ACTIVITIES UNDER CHAPTER 237, HRS — GENERAL EXCISE TAX LAW

AMOUNT

ACT. CODE

SUBTOTAL — General Excise Tax Exemptions/Deductions

ACTIVITIES UNDER CHAPTER 238, HRS — USE TAX LAW

AMOUNT

ACT. CODE

SUBTOTAL — Use Tax Exemptions/Deductions

00

GRAND TOTAL (Transfer to Form G-45, line 4 or Form G-49, line 10.)

(If more space is needed, please attach your schedule.)

Schedule GE (2005)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1