Form 945 - Annual Return Of Withheld Federal Income Tax - 2000

ADVERTISEMENT

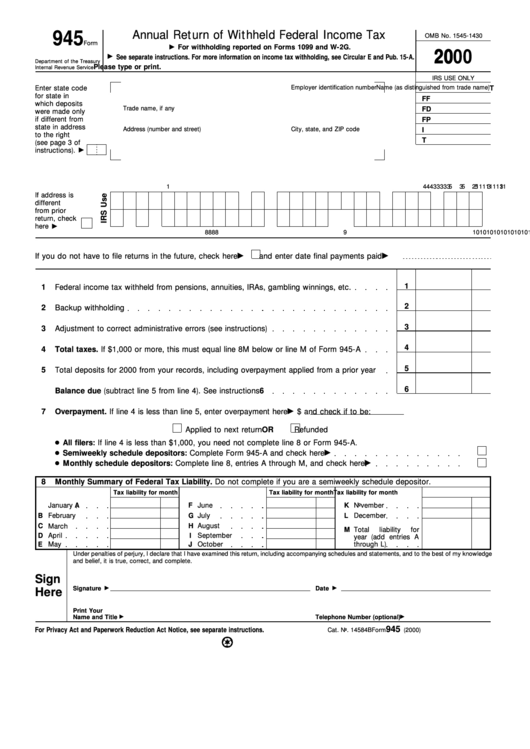

945

Annual Return of Withheld Federal Income Tax

OMB No. 1545-1430

Form

For withholding reported on Forms 1099 and W-2G.

2000

See separate instructions. For more information on income tax withholding, see Circular E and Pub. 15-A.

Department of the Treasury

Please type or print.

Internal Revenue Service

IRS USE ONLY

Name (as distinguished from trade name)

Employer identification number

Enter state code

T

for state in

FF

which deposits

Trade name, if any

FD

were made only

if different from

FP

state in address

Address (number and street)

City, state, and ZIP code

I

to the right

T

(see page 3 of

instructions).

1

1

1

1

1

1

1

1

1

1

2

3

3

3

3

3

3

3

3

4

4

4

5

5

5

If address is

different

from prior

return, check

here

6

7

8

8

8

8

8

8

8

8

9

9

9

9

10

10

10

10

10

10

10

10

10

10

If you do not have to file returns in the future, check here

and enter date final payments paid

1

1

Federal income tax withheld from pensions, annuities, IRAs, gambling winnings, etc.

2

2

Backup withholding

3

3

Adjustment to correct administrative errors (see instructions)

4

4

Total taxes. If $1,000 or more, this must equal line 8M below or line M of Form 945-A

5

5

Total deposits for 2000 from your records, including overpayment applied from a prior year

6

6

Balance due (subtract line 5 from line 4). See instructions

7

Overpayment. If line 4 is less than line 5, enter overpayment here

$

and check if to be:

Applied to next return

OR

Refunded

● All filers: If line 4 is less than $1,000, you need not complete line 8 or Form 945-A.

● Semiweekly schedule depositors: Complete Form 945-A and check here

● Monthly schedule depositors: Complete line 8, entries A through M, and check here

8

Monthly Summary of Federal Tax Liability. Do not complete if you are a semiweekly schedule depositor.

Tax liability for month

Tax liability for month

Tax liability for month

A

January

F

June

K

November

B

February

G

July

L

December

C

March

H

August

M

Total

liability

for

D

April

I

September

year (add entries A

May

J

October

through L)

E

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete.

Sign

Signature

Date

Here

Print Your

Name and Title

Telephone Number (optional)

945

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 14584B

Form

(2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2