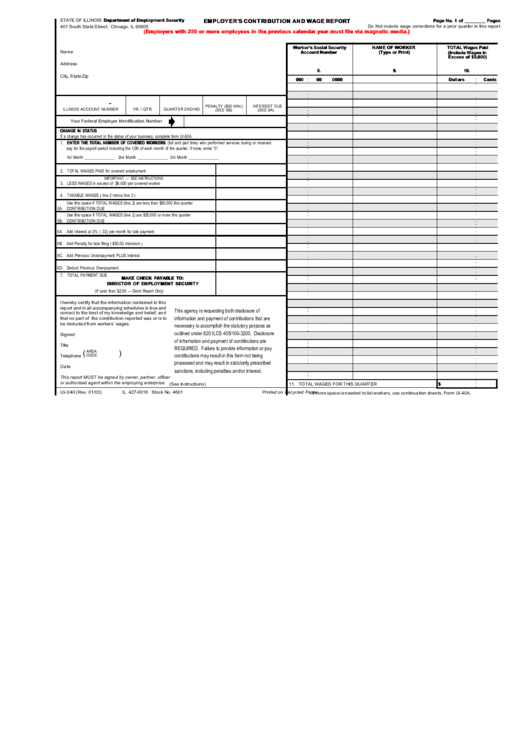

EMPLOYER’S CONTRIBUTION AND WAGE REPORT

STATE OF ILLINOIS Department of Employment Security

Page No. 1 of ________ Pages

401 South State Street, Chicago, IL 60605

Do Not include wage corrections for a prior quarter in this report.

(Employers with 250 or more employees in the previous calendar year must file via magnetic media.)

Worker’s Social Security

NAME OF WORKER

TOTAL Wages Paid

Account Number

(Type or Print)

(Include Wages in

Name

Excess of $9,000)

Address

8.

9.

10.

City, State Zip

000

00

0000

Dollars

Cents

-

PENALTY ($50 MIN.)

INTEREST DUE

ILLINOIS ACCOUNT NUMBER

YR. / QTR.

QUARTER ENDING

(SEE 6B)

(SEE 6A)

Your Federal Employer Identification Number

CHANGE IN STATUS

If a change has occurred in the status of your business, complete form UI-50A.

1. ENTER THE TOTAL NUMBER OF COVERED WORKERS (full and part time) who performed services during or received

pay for the payroll period including the 12th of each month of the quarter. If none, enter “0”.

1st Month _______________ 2nd Month _______________ 3rd Month _______________

2. TOTAL WAGES PAID for covered employment

IMPORTANT — SEE INSTRUCTIONS

3. LESS WAGES in excess of $9,000 per covered worker

4. TAXABLE WAGES ( line 2 minus line 3 )

Use this space if TOTAL WAGES (line 2) are less than $50,000 this quarter

5A. CONTRIBUTION DUE

Use this space if TOTAL WAGES (line 2) are $50,000 or more this quarter

5B. CONTRIBUTION DUE

6A. Add Interest at 2% ( .02) per month for late payment

6B. Add Penalty for late filing ( $50.00 minimum )

6C. Add Previous Underpayment PLUS interest

6D. Deduct Previous Overpayment

7. TOTAL PAYMENT DUE

MAKE CHECK PAYABLE TO:

DIRECTOR OF EMPLOYMENT SECURITY

(If Less than $2.00 — Send Report Only)

I hereby certify that the information contained in this

report and in all accompanying schedules is true and

This agency is requesting both disclosure of

correct to the best of my knowledge and belief; and

information and payment of contributions that are

that no part of the contribution reported was or is to

necessary to accomplish the statutory purpose as

be deducted from workers’ wages.

outlined under 820 ILCS 405/100-3200. Disclosure

Signed ...........................................................

of information and payment of contributions are

Title ...............................................................

REQUIRED. Failure to provide information or pay

(

AREA

)

contributions may result in this form not being

CODE

Telephone .......................................................

processed and may result in statutorily prescribed

Date ..............................................................

sanctions, including penalties and/or interest.

This report MUST be signed by owner, partner, officer

or authorized agent within the employing enterprise.

$

(See Instructions)

11. TOTAL WAGES FOR THIS QUARTER

UI-3/40 (Rev. 01/03)

IL 427-0018 Stock No. 4601

Printed on Recycled Paper

If more space is needed to list workers, use continuation sheets, Form UI-40A.

1

1 2

2