Truth In Lending Form

ADVERTISEMENT

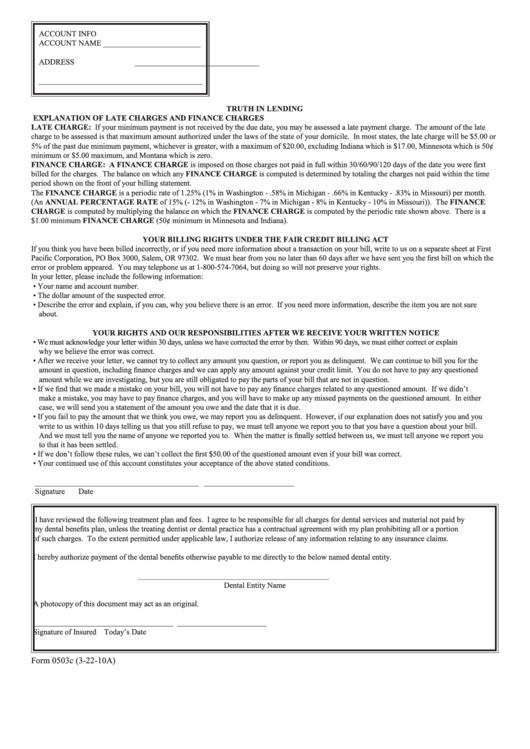

ACCOUNT INFO

ACCOUNT NAME _________________________

ADDRESS ________________________________

__________________________________________

TRUTH IN LENDING

EXPLANATION OF LATE CHARGES AND FINANCE CHARGES

LATE CHARGE: If your minimum payment is not received by the due date, you may be assessed a late payment charge. The amount of the late

charge to be assessed is that maximum amount authorized under the laws of the state of your domicile. In most states, the late charge will be $5.00 or

5% of the past due minimum payment, whichever is greater, with a maximum of $20.00, excluding Indiana which is $17.00, Minnesota which is 50¢

minimum or $5.00 maximum, and Montana which is zero.

FINANCE CHARGE: A FINANCE CHARGE is imposed on those charges not paid in full within 30/60/90/120 days of the date you were first

billed for the charges. The balance on which any FINANCE CHARGE is computed is determined by totaling the charges not paid within the time

period shown on the front of your billing statement.

The FINANCE CHARGE is a periodic rate of 1.25% (1% in Washington - .58% in Michigan - .66% in Kentucky - .83% in Missouri) per month.

(An ANNUAL PERCENTAGE RATE of 15% (- 12% in Washington - 7% in Michigan - 8% in Kentucky - 10% in Missouri)). The FINANCE

CHARGE is computed by multiplying the balance on which the FINANCE CHARGE is computed by the periodic rate shown above. There is a

$1.00 minimum FINANCE CHARGE (50¢ minimum in Minnesota and Indiana).

YOUR BILLING RIGHTS UNDER THE FAIR CREDIT BILLING ACT

If you think you have been billed incorrectly, or if you need more information about a transaction on your bill, write to us on a separate sheet at First

Pacific Corporation, PO Box 3000, Salem, OR 97302. We must hear from you no later than 60 days after we have sent you the first bill on which the

error or problem appeared. You may telephone us at 1-800-574-7064, but doing so will not preserve your rights.

In your letter, please include the following information:

• Your name and account number.

• The dollar amount of the suspected error.

• Describe the error and explain, if you can, why you believe there is an error. If you need more information, describe the item you are not sure

about.

YOUR RIGHTS AND OUR RESPONSIBILITIES AFTER WE RECEIVE YOUR WRITTEN NOTICE

• We must acknowledge your letter within 30 days, unless we have corrected the error by then. Within 90 days, we must either correct or explain

why we believe the error was correct.

• After we receive your letter, we cannot try to collect any amount you question, or report you as delinquent. We can continue to bill you for the

amount in question, including finance charges and we can apply any amount against your credit limit. You do not have to pay any questioned

amount while we are investigating, but you are still obligated to pay the parts of your bill that are not in question.

• If we find that we made a mistake on your bill, you will not have to pay any finance charges related to any questioned amount. If we didn’t

make a mistake, you may have to pay finance charges, and you will have to make up any missed payments on the questioned amount. In either

case, we will send you a statement of the amount you owe and the date that it is due.

• If you fail to pay the amount that we think you owe, we may report you as delinquent. However, if our explanation does not satisfy you and you

write to us within 10 days telling us that you still refuse to pay, we must tell anyone we report you to that you have a question about your bill.

And we must tell you the name of anyone we reported you to. When the matter is finally settled between us, we must tell anyone we report you

to that it has been settled.

• If we don’t follow these rules, we can’t collect the first $50.00 of the questioned amount even if your bill was correct.

• Your continued use of this account constitutes your acceptance of the above stated conditions.

__________________________________________

_______________________

Signature

Date

I have reviewed the following treatment plan and fees. I agree to be responsible for all charges for dental services and material not paid by

my dental benefits plan, unless the treating dentist or dental practice has a contractual agreement with my plan prohibiting all or a portion

of such charges. To the extent permitted under applicable law, I authorize release of any information relating to any insurance claims.

I hereby authorize payment of the dental benefits otherwise payable to me directly to the below named dental entity.

_________________________________________________

Dental Entity Name

A photocopy of this document may act as an original.

____________________________________

_______________________

Signature of Insured

Today’s Date

Form 0503c (3-22-10A)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1