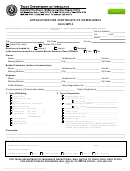

Form T-64 - Texas Disclosure - Texas Department Of Insurance Page 2

ADVERTISEMENT

This form provides additional disclosures and

Texas Disclosure

acknowledgements required in Texas. It is used with the

federal Closing Disclosure form.

Form T-64

Real Estate Commission Disbursement

Portions of the Real Estate Commissions disclosed on the Closing Disclosure will be disbursed to:

Other Disclosures

Although not required, this section may be used to disclose individual recording charges included on Line 01 of

Section E of the Closing Disclosure, or to disclose a breakdown of other charges that were combined on the Closing

Disclosure:

Document Name

Recording Fee

Document Name

Recording Fee

Closing Disclosure Charge Name

Included in Closing Disclosure Charge

The Closing Disclosure was assembled from the best information available from other sources. The Settlement

Agent cannot guarantee the accuracy of that information.

Tax and insurance prorations and reserves were based on figures for the preceding year or supplied by others, or are

estimates for current year. If there is any change for the current year, all necessary adjustments must be made

directly between Seller and Borrower, if applicable.

I (We) acknowledge receiving this Texas Disclosure and the Closing Disclosure. I (We) authorize the Settlement

Agent to make the expenditures and disbursements on the Closing Disclosure and I (we) approve those payments. If

I am (we are) the Borrower(s), I (we) acknowledge receiving the Loan Funds, if applicable, in the amount on the

Closing Disclosure.

________________________________________

________________________________________

Borrower:

Borrower:

________________________________________

________________________________________

Seller:

Seller:

Settlement Agent:

By: _________________________________

Escrow Officer

GF #

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2