Form T-64 - Texas Disclosure - Texas Department Of Insurance

ADVERTISEMENT

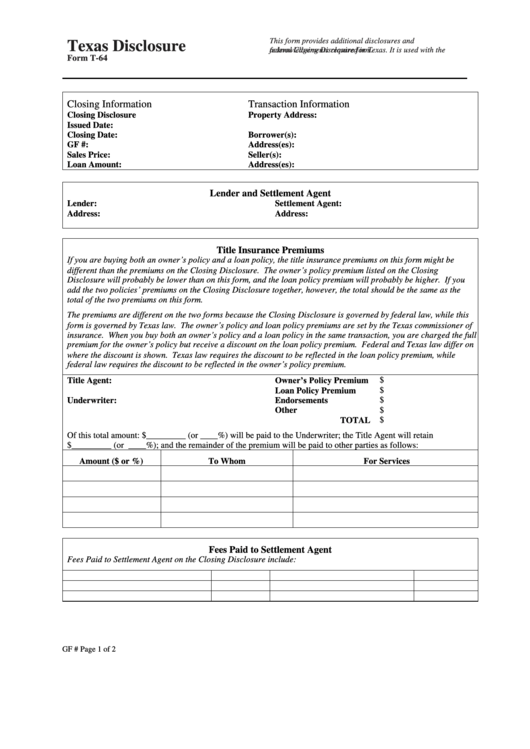

This form provides additional disclosures and

Texas Disclosure

acknowledgements required in Texas. It is used with the

federal Closing Disclosure form.

Form T-64

Closing Information

Transaction Information

Closing Disclosure

Property Address:

Issued Date:

Closing Date:

Borrower(s):

GF #:

Address(es):

Sales Price:

Seller(s):

Loan Amount:

Address(es):

Lender and Settlement Agent

Lender:

Settlement Agent:

Address:

Address:

Title Insurance Premiums

If you are buying both an owner’s policy and a loan policy, the title insurance premiums on this form might be

different than the premiums on the Closing Disclosure. The owner’s policy premium listed on the Closing

Disclosure will probably be lower than on this form, and the loan policy premium will probably be higher. If you

add the two policies’ premiums on the Closing Disclosure together, however, the total should be the same as the

total of the two premiums on this form.

The premiums are different on the two forms because the Closing Disclosure is governed by federal law, while this

form is governed by Texas law. The owner’s policy and loan policy premiums are set by the Texas commissioner of

insurance. When you buy both an owner’s policy and a loan policy in the same transaction, you are charged the full

premium for the owner’s policy but receive a discount on the loan policy premium. Federal and Texas law differ on

where the discount is shown. Texas law requires the discount to be reflected in the loan policy premium, while

federal law requires the discount to be reflected in the owner’s policy premium.

Owner’s Policy Premium

Title Agent:

$

Loan Policy Premium

$

Underwriter:

Endorsements

$

$

Other

$

TOTAL

Of this total amount: $_________ (or ____%) will be paid to the Underwriter; the Title Agent will retain

$_________ (or ____%); and the remainder of the premium will be paid to other parties as follows:

Amount ($ or %)

To Whom

For Services

Fees Paid to Settlement Agent

Fees Paid to Settlement Agent on the Closing Disclosure include:

GF #

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2