Council Tax Exemption Claim Form - Unoccupied Property Falkirk Council

ADVERTISEMENT

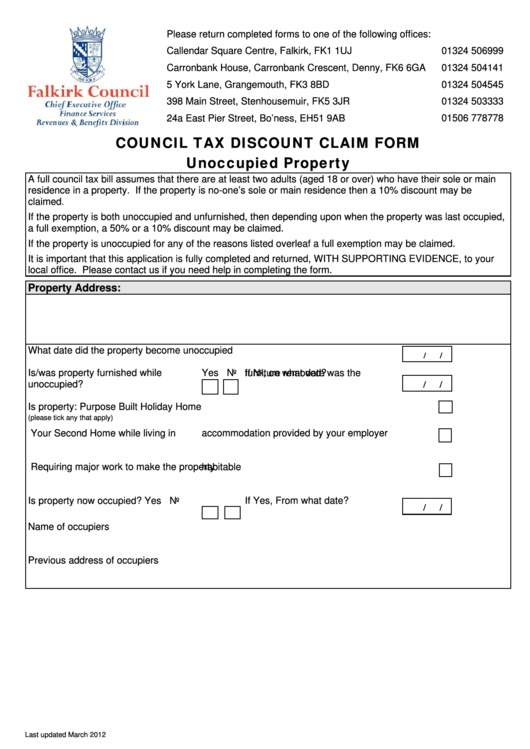

Please return completed forms to one of the following offices:

Callendar Square Centre, Falkirk, FK1 1UJ

01324 506999

Carronbank House, Carronbank Crescent, Denny, FK6 6GA

01324 504141

5 York Lane, Grangemouth, FK3 8BD

01324 504545

398 Main Street, Stenhousemuir, FK5 3JR

01324 503333

24a East Pier Street, Bo’ness, EH51 9AB

01506 778778

COUNCIL TAX DISCOUNT CLAIM FORM

Unoccupied Property

A full council tax bill assumes that there are at least two adults (aged 18 or over) who have their sole or main

residence in a property. If the property is no-one’s sole or main residence then a 10% discount may be

claimed.

If the property is both unoccupied and unfurnished, then depending upon when the property was last occupied,

a full exemption, a 50% or a 10% discount may be claimed.

If the property is unoccupied for any of the reasons listed overleaf a full exemption may be claimed.

It is important that this application is fully completed and returned, WITH SUPPORTING EVIDENCE, to your

local office. Please contact us if you need help in completing the form.

Property Address:

What date did the property become unoccupied

/

/

Is/was property furnished while

Yes No If No, on what date was the

unoccupied?

furniture removed?

/

/

Is property:

Purpose Built Holiday Home

(please tick any that apply)

Your Second Home while living in

accommodation provided by your employer

Requiring major work to make the property

habitable

Is property now occupied?

Yes No If Yes, From what date?

/

/

Name of occupiers

Previous address of occupiers

Last updated March 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2