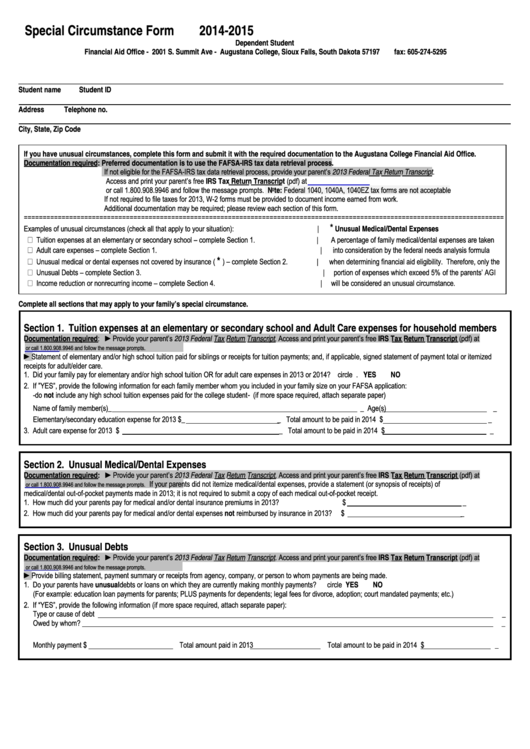

Special Circumstance Form

2014-2015

Dependent Student

Financial Aid Office - 2001 S. Summit Ave - Augustana College, Sioux Falls, South Dakota 57197

fax: 605-274-5295

financial.aid@augie.edu

____________________________________________________________________________________________________________________________

Student name

Student ID

Address

Telephone no.

City, State, Zip Code

If you have unusual circumstances, complete this form and submit it with the required documentation to the Augustana College Financial Aid Office.

Documentation required: Preferred documentation is to use the FAFSA-IRS tax data retrieval process.

If not eligible for the FAFSA-IRS tax data retrieval process, provide your parent’s 2013 Federal Tax Return Transcript.

Access and print your parent’s free IRS Tax Return Transcript (pdf) at

or call 1.800.908.9946 and follow the message prompts. Note: Federal 1040, 1040A, 1040EZ tax forms are not acceptable

If not required to file taxes for 2013, W-2 forms must be provided to document income earned from work.

Additional documentation may be required; please review each section of this form.

===============================================================================================================================

*

Examples of unusual circumstances (check all that apply to your situation):

|

Unusual Medical/Dental Expenses

Tuition expenses at an elementary or secondary school – complete Section 1.

|

A percentage of family medical/dental expenses are taken

Adult care expenses – complete Section 1.

|

into consideration by the federal needs analysis formula

*

Unusual medical or dental expenses not covered by insurance (

) – complete Section 2.

|

when determining financial aid eligibility. Therefore, only the

Unusual Debts – complete Section 3.

|

portion of expenses which exceed 5% of the parents’ AGI

Income reduction or nonrecurring income – complete Section 4.

|

will be considered an unusual circumstance.

Complete all sections that may apply to your family’s special circumstance.

Section 1. Tuition expenses at an elementary or secondary school and Adult Care expenses for household members

Documentation required: ►Provide your parent’s 2013 Federal Tax Return Transcript. Access and print your parent’s free IRS Tax Return Transcript (pdf) at

or call 1.800.908.9946 and follow the message prompts.

►Statement of elementary and/or high school tuition paid for siblings or receipts for tuition payments; and, if applicable, signed statement of payment total or itemized

receipts for adult/elder care.

1. Did your family pay for elementary and/or high school tuition OR for adult care expenses in 2013 or 2014? circle one..... YES

NO

2. If ”YES”, provide the following information for each family member whom you included in your family size on your FAFSA application:

-do not include any high school tuition expenses paid for the college student- (if more space required, attach separate paper)

Name of family member(s)_

_ Age(s)

_

Elementary/secondary education expense for 2013 $_

_ Total amount to be paid in 2014 $

_

3. Adult care expense for 2013 $

_ Total amount to be paid in 2014 $

_

Section 2. Unusual Medical/Dental Expenses

Documentation required: ►Provide your parent’s 2013 Federal Tax Return Transcript. Access and print your parent’s free IRS Tax Return Transcript (pdf) at

If your parents did not itemize medical/dental expenses, provide a statement (or synopsis of receipts) of

or call 1.800.908.9946 and follow the message prompts.

medical/dental out-of-pocket payments made in 2013; it is not required to submit a copy of each medical out-of-pocket receipt.

1. How much did your parents pay for medical and/or dental insurance premiums in 2013?

$

_

2. How much did your parents pay for medical and/or dental expenses not reimbursed by insurance in 2013?

$

_

Section 3. Unusual Debts

Documentation required: ►Provide your parent’s 2013 Federal Tax Return Transcript. Access and print your parent’s free IRS Tax Return Transcript (pdf) at

or call 1.800.908.9946 and follow the message prompts.

►Provide billing statement, payment summary or receipts from agency, company, or person to whom payments are being made.

1. Do your parents have unusual debts or loans on which they are currently making monthly payments?

circle one..... YES

NO

(For example: education loan payments for parents; PLUS payments for dependents; legal fees for divorce, adoption; court mandated payments; etc.)

2. If “YES”, provide the following information (if more space required, attach separate paper):

Type or cause of debt

_

Owed by whom?

_

Monthly payment $

Total amount paid in 2013

Total amount to be paid in 2014 $

_

1

1 2

2