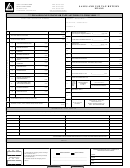

City of Boulder

Initial Use Tax Return

Department of Finance

Sales/Use Tax Division

City of Boulder

Business Name: _______________________________________

City License #: _________

Mailing Address: _______________________________________

_______________________________________

DUE DATE of this return is the 20th day of the month following the month

of inception of business in Boulder

TAXABLE AMOUNT

1.

OFFICE FURNITURE, SUPPLIES AND EQUIPMENT:

Computers, software, copiers, fax machines, printers, telephones,

business machines, office furniture, office supplies, etc.

$________________

2.

RETAIL FURNITURE, EQUIPMENT AND FIXTURES:

Cash registers, counters, display racks and units, shelving,

booths, tables, chairs, other restaurant furnishings, etc.

$________________

3.

FOOD SERVICE PROCESSING EQUIPMENT AND SUPPLIES

Coolers, freezers, ovens, fryers, mixers, knives, and other kitchen

equipment and supplies, dinnerware, linens, catering equipment, etc.

$________________

4.

MANUFACTURING, WAREHOUSE AND SHOP EQUIPMENT

Shop equipment and supplies, tools, compressors, conveyors,

packaging equipment, bailers, forklifts, manufacturing equipment, etc.

$________________

5.

MEDICAL TOOLS, EQUIPMENT AND SUPPLIES

Medical beds, dental chairs, medical supplies and tools, disposable

supplies, sterilization equipment, laboratory equipment, etc.

$________________

6.

SIGNS AND OTHER OUTDOOR DISPLAYS

$________________

CLEANING SUPPLIES AND JANITORIAL EQUIPMENT

7.

$________________

8.

ALL OTHER TANGIBLE PERSONAL PROPERTY & TAXABLE SERVICES

$________________

(Please attach supplemental schedule describing these purchases)

0.00

9.

TOTAL TAXABLE AMOUNT (Total lines 1 through 8)

$________________

0.00

10.

GROSS USE TAX DUE (Line 9 x 3.41%)

$________________

11.

CREDIT FOR TAX PAID TO BOULDER OR OTHER MUNICIPALITY

$________________

0.00

12.

NET USE TAX DUE (Subtract line 11 from line 10)

$________________

13.

PENALTY (10% of line 12)

$________________

LATE FILING CHARGES

Add if return will be

14.

INTEREST (1% of line 12 for each month past due)

$________________

postmarked after the due date

0.00

15.

TOTAL AMOUNT DUE (Total lines 12 through 14)

$________________

Make check payable to City of Boulder

Under penalties of perjury, I declare that I have examined this Initial Use Tax Return and it is true and

correct to the best of my knowledge and belief.

Taxpayer

Signature

Signature

Date

.

Printed Name

Title

Phone Number

City of Boulder

Sales Tax Division

PO Box 791

Boulder, CO 80306-0791

(303) 441-3921

Phone:

(303) 441-3015

1

1 2

2