2014-2015 Student Tax Filing Status Statement Template

ADVERTISEMENT

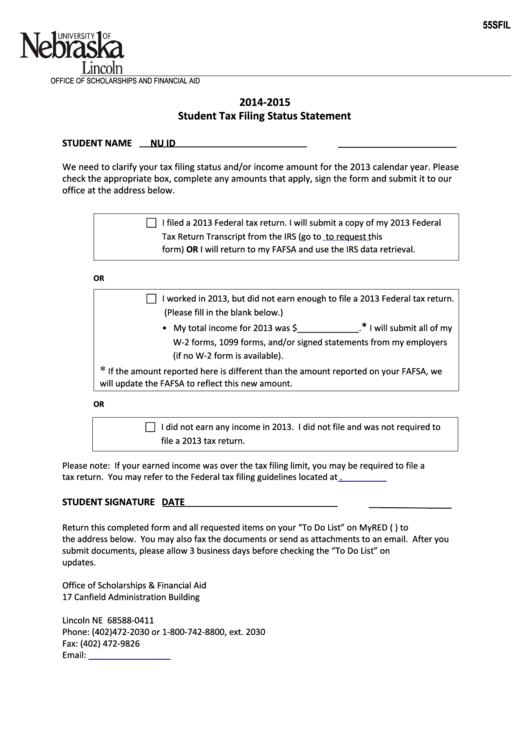

55SFIL

OFFICE OF SCHOLARSHIPS AND FINANCIAL AID

2014-2015

Student Tax Filing Status Statement

STUDENT NAME

NU ID

We need to clarify your tax filing status and/or income amount for the 2013 calendar year. Please

check the appropriate box, complete any amounts that apply, sign the form and submit it to our

office at the address below.

I filed a 2013 Federal tax return. I will submit a copy of my 2013 Federal

Tax Return Transcript from the IRS (go to

to request this

form) OR I will return to my FAFSA and use the IRS data retrieval.

OR

I worked in 2013, but did not earn enough to file a 2013 Federal tax return.

(Please fill in the blank below.)

*

• My total income for 2013 was $_____________.

I will submit all of my

W-2 forms, 1099 forms, and/or signed statements from my employers

(if no W-2 form is available).

*

If the amount reported here is different than the amount reported on your FAFSA, we

will update the FAFSA to reflect this new amount.

OR

I did not earn any income in 2013. I did not file and was not required to

file a 2013 tax return.

Please note: If your earned income was over the tax filing limit, you may be required to file a

tax return. You may refer to the Federal tax filing guidelines located at .

STUDENT SIGNATURE

DATE

Return this completed form and all requested items on your “To Do List” on MyRED (myred.unl.edu) to

the address below. You may also fax the documents or send as attachments to an email. After you

submit documents, please allow 3 business days before checking the “To Do List” on myred.unl.edu for

updates.

Office of Scholarships & Financial Aid

17 Canfield Administration Building

P.O. Box 880411

Lincoln NE 68588-0411

Phone: (402)472-2030 or 1-800-742-8800, ext. 2030

Fax: (402) 472-9826

Email:

financialaid@unl.edu

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1