Substitute W-9 Form - Ochra Housing & Redevelopment Authority, County Of Olmsted, Minnesota

ADVERTISEMENT

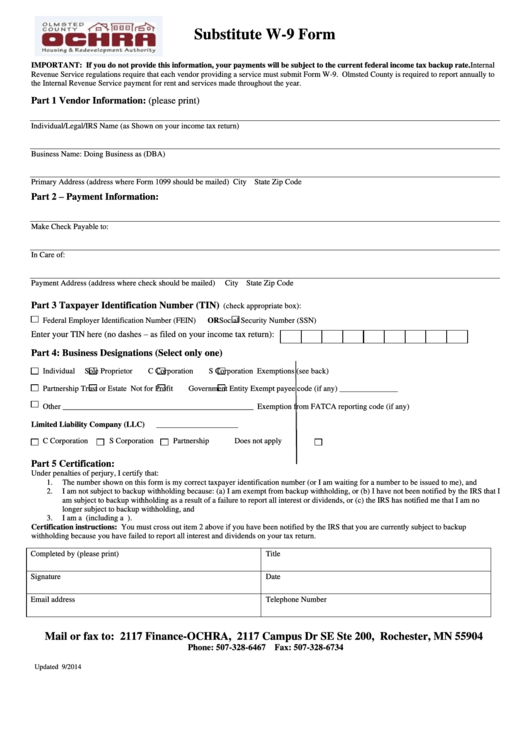

Substitute W-9 Form

IMPORTANT: If you do not provide this information, your payments will be subject to the current federal income tax backup rate. Internal

Revenue Service regulations require that each vendor providing a service must submit Form W-9. Olmsted County is required to report annually to

the Internal Revenue Service payment for rent and services made throughout the year.

Part 1 Vendor Information: (please print)

Individual/Legal/IRS Name (as Shown on your income tax return)

Business Name: Doing Business as (DBA)

Primary Address (address where Form 1099 should be mailed)

City

State

Zip Code

Part 2 – Payment Information:

Make Check Payable to:

In Care of:

Payment Address (address where check should be mailed)

City

State

Zip Code

Part 3 Taxpayer Identification Number (TIN)

(check appropriate box):

Federal Employer Identification Number (FEIN)

OR

Social Security Number (SSN)

Enter your TIN here (no dashes – as filed on your income tax return):

Part 4: Business Designations (Select only one)

Individual

Sole Proprietor

C Corporation

S Corporation

Exemptions (see back)

Partnership

Trust or Estate

Not for Profit

Government Entity

Exempt payee code (if any) _______________

Other _________________________________________________

Exemption from FATCA reporting code (if any)

Limited Liability Company (LLC)

_____________________

C Corporation

S Corporation

Partnership

Does not apply

Part 5 Certification:

Under penalties of perjury, I certify that:

1.

The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the IRS that I

am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no

longer subject to backup withholding, and

3.

I am a U.S. person (including a U.S. resident alien).

Certification instructions: You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup

withholding because you have failed to report all interest and dividends on your tax return.

Completed by (please print)

Title

Signature

Date

Email address

Telephone Number

Mail or fax to: 2117 Finance-OCHRA, 2117 Campus Dr SE Ste 200, Rochester, MN 55904

Phone: 507-328-6467 Fax: 507-328-6734

Updated 9/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2