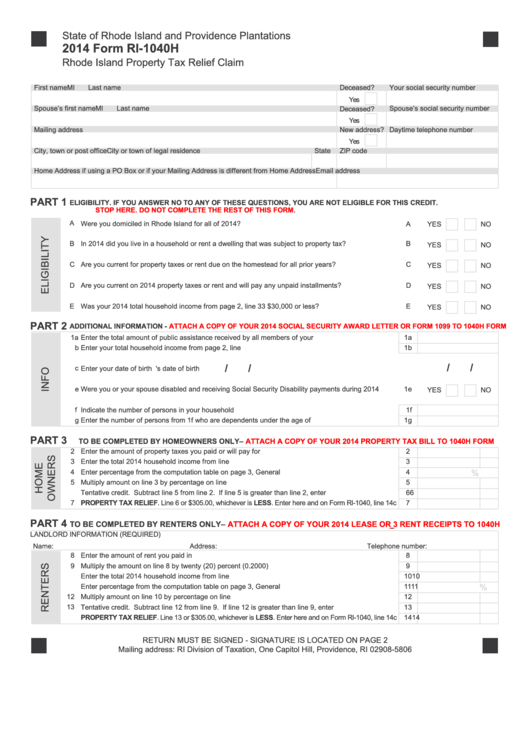

State of Rhode Island and Providence Plantations

2014 Form RI-1040H

Rhode Island Property Tax Relief Claim

First name

MI

Last name

Deceased?

Your social security number

Yes

Spouse’s first name

MI

Last name

Spouse’s social security number

Deceased?

Yes

Mailing address

New address?

Daytime telephone number

Yes

City, town or post office

State

ZIP code

City or town of legal residence

Home Address if using a PO Box or if your Mailing Address is different from Home Address

Email address

PART 1

ELIGIBILITY. IF YOU ANSWER NO TO ANY OF THESE QUESTIONS, YOU ARE NOT ELIGIBLE FOR THIS CREDIT.

STOP HERE.

DO NOT COMPLETE THE REST OF THIS FORM.

A

Were you domiciled in Rhode Island for all of 2014?..................................................................................

A

YES

NO

B

In 2014 did you live in a household or rent a dwelling that was subject to property tax?............................

B

YES

NO

C

Are you current for property taxes or rent due on the homestead for all prior years?.................................

C

YES

NO

D

Are you current on 2014 property taxes or rent and will pay any unpaid installments?..............................

D

YES

NO

E

Was your 2014 total household income from page 2, line 33 $30,000 or less?..........................................

E

YES

NO

PART 2

ADDITIONAL INFORMATION -

ATTACH A COPY OF YOUR 2014 SOCIAL SECURITY AWARD LETTER OR FORM 1099 TO 1040H FORM

1 a

Enter the total amount of public assistance received by all members of your household...........................

1a

b

Enter your total household income from page 2, line 33............................................................................. 1b

/

/

/

/

c

Enter your date of birth ............................

1d Enter spouse's date of birth .....................

e

Were you or your spouse disabled and receiving Social Security Disability payments during 2014 ..........

1e

YES

NO

Indicate the number of persons in your household .....................................................................................

1f

f

g

Enter the number of persons from 1f who are dependents under the age of 18........................................

1g

PART 3

TO BE COMPLETED BY HOMEOWNERS ONLY–

ATTACH A COPY OF YOUR 2014 PROPERTY TAX BILL TO 1040H FORM

2

Enter the amount of property taxes you paid or will pay for 2014...............................................................

2

Enter the total 2014 household income from line 1b...................................................................................

3

3

Enter percentage from the computation table on page 3, General Instructions..........................................

4

%

5

Multiply amount on line 3 by percentage on line 4......................................................................................

5

6

Tentative credit. Subtract line 5 from line 2. If line 5 is greater than line 2, enter zero..............................

6

7

PROPERTY TAX RELIEF. Line 6 or $305.00, whichever is LESS. Enter here and on Form RI-1040, line 14c

7

PART 4

TO BE COMPLETED BY RENTERS ONLY–

ATTACH A COPY OF YOUR 2014 LEASE OR 3 RENT RECEIPTS TO 1040H

LANDLORD INFORMATION (REQUIRED)

Name:

Address:

Telephone number:

8

Enter the amount of rent you paid in 2014..................................................................................................

8

9

Multiply the amount on line 8 by twenty (20) percent (0.2000) ....................................................................

9

10

Enter the total 2014 household income from line 1b................................................................................... 10

11

Enter percentage from the computation table on page 3, General Instructions.......................................... 11

%

12

Multiply amount on line 10 by percentage on line 11...................................................................................

12

13

Tentative credit. Subtract line 12 from line 9. If line 12 is greater than line 9, enter zero.......................... 13

14

PROPERTY TAX RELIEF. Line 13 or $305.00, whichever is LESS. Enter here and on Form RI-1040, line 14c

14

RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

1

1 2

2 3

3