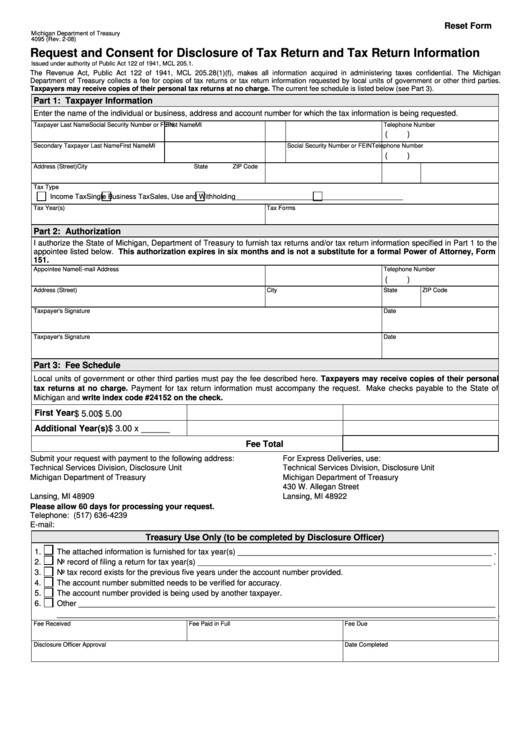

Reset Form

Michigan Department of Treasury

4095 (Rev. 2-08)

Request and Consent for Disclosure of Tax Return and Tax Return Information

Issued under authority of Public Act 122 of 1941, MCL 205.1.

The Revenue Act, Public Act 122 of 1941, MCL 205.28(1)(f), makes all information acquired in administering taxes confidential. The Michigan

Department of Treasury collects a fee for copies of tax returns or tax return information requested by local units of government or other third parties.

Taxpayers may receive copies of their personal tax returns at no charge. The current fee schedule is listed below (see Part 3).

Part 1: Taxpayer Information

Enter the name of the individual or business, address and account number for which the tax information is being requested.

Taxpayer Last Name

First Name

MI

Social Security Number or FEIN

Telephone Number

(

)

Secondary Taxpayer Last Name

First Name

MI

Social Security Number or FEIN

Telephone Number

(

)

Address (Street)

City

State

ZIP Code

Tax Type

Income Tax

Single Business Tax

Sales, Use and Withholding

___________________________________________

Tax Year(s)

Tax Forms

Part 2: Authorization

I authorize the State of Michigan, Department of Treasury to furnish tax returns and/or tax return information specified in Part 1 to the

appointee listed below. This authorization expires in six months and is not a substitute for a formal Power of Attorney, Form

151.

Appointee Name

E-mail Address

Telephone Number

(

)

Address (Street)

City

State

ZIP Code

Taxpayer's Signature

Date

Taxpayer's Signature

Date

Part 3: Fee Schedule

Local units of government or other third parties must pay the fee described here. Taxpayers may receive copies of their personal

tax returns at no charge. Payment for tax return information must accompany the request. Make checks payable to the State of

Michigan and write index code #24152 on the check.

First Year

$ 5.00

$ 5.00

Additional Year(s)

$ 3.00 x ______

Fee Total

Submit your request with payment to the following address:

For Express Deliveries, use:

Technical Services Division, Disclosure Unit

Technical Services Division, Disclosure Unit

Michigan Department of Treasury

Michigan Department of Treasury

P.O. Box 30698

430 W. Allegan Street

Lansing, MI 48909

Lansing, MI 48922

Please allow 60 days for processing your request.

Telephone: (517) 636-4239

E-mail:

Treas_Disclosure@michigan.gov

Treasury Use Only (to be completed by Disclosure Officer)

1.

The attached information is furnished for tax year(s) __________________________________________________________ .

2.

No record of filing a return for tax year(s) ___________________________________________________________________ .

3.

No tax record exists for the previous five years under the account number provided.

4.

The account number submitted needs to be verified for accuracy.

5.

The account number provided is being used by another taxpayer.

6.

Other _______________________________________________________________________________________________

____________________________________________________________________________________________________ .

Fee Received

Fee Paid in Full

Fee Due

Disclosure Officer Approval

Date Completed

1

1