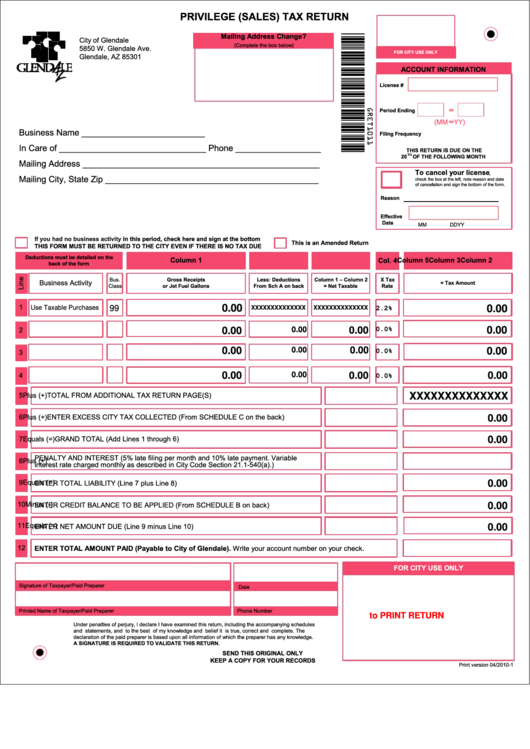

PRIVILEGE (SALES) TAX RETURN

Mailing Address Change?

City of Glendale

(Complete the box below)

5850 W. Glendale Ave.

FOR CITY USE ONLY

Glendale, AZ 85301

ACCOUNT INFORMATION

License #

-

Period Ending

-

(MM YY)

Business Name __________________________

Filing Frequency

In Care of _______________________________ Phone __________________

THIS RETURN IS DUE ON THE

TH

20

OF THE FOLLOWING MONTH

Mailing Address __________________________________________________

To cancel your license

,

Mailing City, State Zip _____________________________________________

check the box at the left, note reason and date

of cancellation and sign the bottom of the form.

Reason

Effective

Date

MM

DD

YY

If you had no business activity

in this period, check here and sign at the bottom

This is an Amended Return

THIS FORM MUST BE RETURNED TO THE CITY EVEN IF THERE IS NO TAX DUE

Deductions must be detailed on the

Column 1

Column 2

Column 3

Column 5

Col. 4

back of the form

Bus.

Gross Receipts

Less: Deductions

Column 1 – Column 2

X Tax

Business Activity

= Tax Amount

Class

or Jet Fuel Gallons

From Sch A on back

= Net Taxable

Rate

0.00

1

99

0.00

Use Taxable Purchases

XXXXXXXXXXXXXX

XXXXXXXXXXXXXX

2.2%

0.00

0.00

0.00

0.00

2

0.0%

0.00

0.00

0.00

0.00

0.0%

3

0.00

0.00

0.00

0.00

4

0.0%

XXXXXXXXXXXXXX

5

TOTAL FROM ADDITIONAL TAX RETURN PAGE(S)

Plus (+)

6

ENTER EXCESS CITY TAX COLLECTED (From SCHEDULE C on the back)

Plus (+)

0.00

0.00

7

GRAND TOTAL (Add Lines 1 through 6)

Equals (=)

PENALTY AND INTEREST (5% late filing per month and 10% late payment. Variable

8

Plus (+)

interest rate charged monthly as described in City Code Section 21.1-540(a).)

0.00

9

Equals (=)

ENTER TOTAL LIABILITY (Line 7 plus Line 8)

10

Minus (-)

0.00

ENTER CREDIT BALANCE TO BE APPLIED (From SCHEDULE B on back)

11

Equals (=)

0.00

ENTER NET AMOUNT DUE (Line 9 minus Line 10)

12

ENTER TOTAL AMOUNT PAID (Payable to City of Glendale). Write your account number on your check.

FOR CITY USE ONLY

Phone Number

Signature of Taxpayer/Paid Preparer

Date

Phone Number

Printed Name of Taxpayer/Paid Preparer

Phone Number

Click here to PRINT RETURN

Under penalties of perjury, I declare I have examined this return, including the accompanying schedules

and statements, and to the best of my knowledge and belief it is true, correct and complete. The

declaration of the paid preparer is based upon all information of which the preparer has any knowledge.

A SIGNATURE IS REQUIRED TO VALIDATE THIS RETURN.

SEND THIS ORIGINAL ONLY

KEEP A COPY FOR YOUR RECORDS

Print version 04/2010-1

1

1 2

2 3

3 4

4