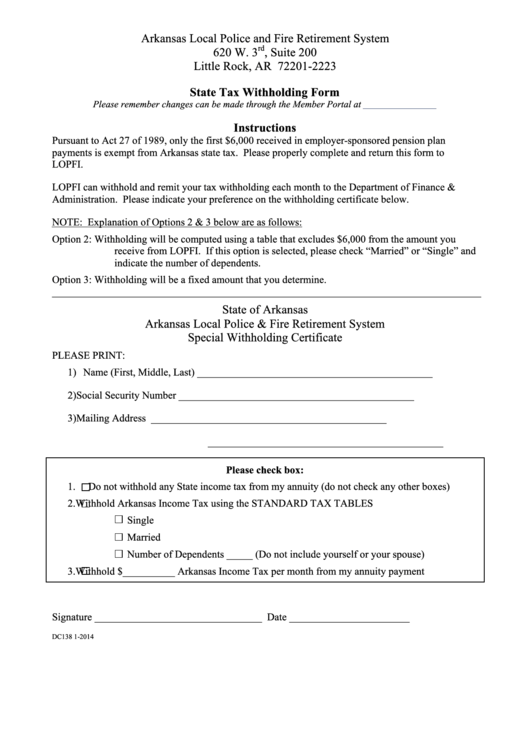

Arkansas Local Police and Fire Retirement System

rd

620 W. 3

, Suite 200

Little Rock, AR 72201-2223

State Tax Withholding Form

Please remember changes can be made through the Member Portal at

Instructions

Pursuant to Act 27 of 1989, only the first $6,000 received in employer-sponsored pension plan

payments is exempt from Arkansas state tax. Please properly complete and return this form to

LOPFI.

LOPFI can withhold and remit your tax withholding each month to the Department of Finance &

Administration. Please indicate your preference on the withholding certificate below.

NOTE: Explanation of Options 2 & 3 below are as follows:

Option 2:

Withholding will be computed using a table that excludes $6,000 from the amount you

receive from LOPFI. If this option is selected, please check “Married” or “Single” and

indicate the number of dependents.

Option 3:

Withholding will be a fixed amount that you determine.

__________________________________________________________________________________

State of Arkansas

Arkansas Local Police & Fire Retirement System

Special Withholding Certificate

PLEASE PRINT:

1) Name (First, Middle, Last)

_____________________________________________

2) Social Security Number

_____________________________________________

3) Mailing Address

_____________________________________________

_____________________________________________

Please check box:

1.

Do not withhold any State income tax from my annuity (do not check any other boxes)

2.

Withhold Arkansas Income Tax using the STANDARD TAX TABLES

Single

Married

Number of Dependents _____ (Do not include yourself or your spouse)

3.

Withhold $__________ Arkansas Income Tax per month from my annuity payment

Signature ________________________________

Date _______________________

DC138 1-2014

1

1