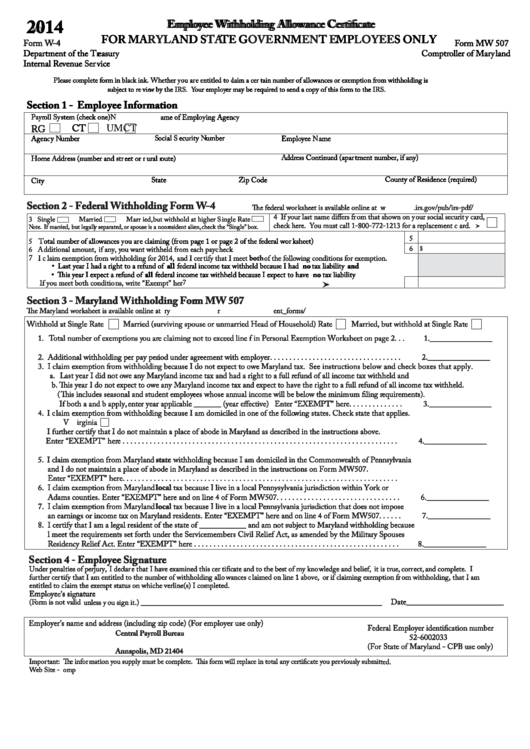

Employee Withholding Allowance Certificate

Employee Withholding Allowance Certificate

2014

2014

2007

FOR MA

FOR MARYLAND S

AND STATE G

TE GOVERNM

RNMENT T EMP

MPLOYEES ONLY

S ONLY

Form W-4 -4

Form MW 507

orm MW 507

Depa

Department of the

tment of the Treasu

easury

Compt

Comptroller of Ma

oller of Maryland

land

Internal R

Internal Revenue

venue Service

vice

Please c

lease complete form in bla

mplete form in black ink

k ink. Whether

hether you a

ou are entitled to

e entitled to claim a ce

laim a certain number of all

tain number of allowances or exempti

wances or exemption f

n from withholding is

om withholding is

subject to

subject to revi view by the I

w by the IRS. Your empl

our employer may be

er may be requi

equired to send a copy of this form to the I

ed to send a copy of this form to the IRS.

S S ection 1 - Empl

ection 1 - Employee Info

yee Information

mation

Payroll oll System (check one)

stem (check one)

Name of Empl

ame of Employing Agen

ing Agency

CT

CT

UM

RG

Social

ocial Secu

ecurity y Number

umber

Empl

Employee

yee Name

ame

Agen

Agency y Number

umber

Add ddress Continued (apa

ess Continued (apartment numbe

tment number, if any)

if any)

Home

Home Add ddress (number and st

ess (number and street or

eet or rural

ural route)

oute)

County of Residence (required)

County of Residence (required)

State

State

Zip Code

Zip Code

City

City

S S ection 2 -

ection 2 - Federal

ederal Withholding

ithholding Form W-4 -4

The federal wo

The federal worksheet is available online at

ksheet is available online at w.irs.g

.irs.gov/pub/irs-pdf/fw4.pdf

v/pub/irs-pdf/fw4.pdf

4 If

4 If your last name differs f

our last name differs from that shown on

om that shown on your social secu

our social security y card

ard,

3 Single

ingle

Mar

Married

ied

Mar

Married

ied, but withhold at higher

but withhold at higher Single Rate

ingle Rate

che

check here

k here. You ou must

ust call 1-800-772-1213 for a replacement

all 1-800-772-1213 for a replacement card.

ard.

Note

ote. If mar

If married

ied, but legal

but legally separated

y separated, or spouse is a non

or spouse is a nonresident alien

esident alien, che

check the

k the “Singl

ingle” b box.

5

5

Total number of all

otal number of allowances

wances you a

ou are e claiming (f

laiming (from page 1 or page 2 of the federal wo

om page 1 or page 2 of the federal worksheet)

ksheet)

6

$

6

Additional amount

dditional amount, if an

if any, you want withheld f

ou want withheld from each pa

om each payche heck .....................................................................................

k .....................................................................................

7 I I claim exemption f

laim exemption from withholding for 2014

om withholding for 2014, and I ce

and I certify that I meet

tify that I meet both

both of the foll

of the following conditions for exemption.

wing conditions for exemption.

• Last year I had a right to a refund of

• Last year I had a right to a refund of all all federal income tax withheld because I had

federal income tax withheld because I had no

no tax liability

tax liability and

and

• This year I expect a refund of

• This year I expect a refund of all all federal income tax withheld because I expect to have

federal income tax withheld because I expect to have no

no tax liability

tax liability

7

If If you meet both conditi

ou meet both conditions ns, write ite “Exemp

Exempt” he here.........................................................................

e.........................................................................

Section 3 - Ma

ection 3 - Maryland

land Withholding

ithholding Form MW 507

m MW 507

The Ma

The Maryland wo

land worksheet is available online at

ksheet is available online at

ent_forms/MW507.pdf

Withhold at Single Rate

Withhold at Single Rate

Married (surviving spouse or unmarried Head of Household) Rate

Married (surviving spouse or unmarried Head of Household) Rate

Married, but withhold at Single Rate

Married, but withhold at Single Rate

1 1 . Total number of exemptions

otal number of exemptions you a

ou are e claiming not to exceed line f in Personal Exemption Worksheet on page 2. . .

laiming not to exceed line f in Personal Exemption Worksheet on page 2. . .

1.________________

1.________________

2. Additional withholding per pay pe

dditional withholding per pay period under ag

iod under agreement with empl

eement with employer. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

yer. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.________________

2.________________

3. I I claim exemption f

laim exemption fro rom withholding be

m withholding because I do not expect to

ause I do not expect to owe Ma

we Maryland tax

land tax. See instructions below and check boxes that apply.

See instructions below and check boxes that apply.

a. Last year I did not

ast year I did not owe any Ma

we any Maryland income tax and had a

land income tax and had a right to a full

ight to a full refund of all income tax withheld and

efund of all income tax withheld and

b b. This year I do not expect to

This year I do not expect to owe any Ma

we any Maryland income tax and expect to have the

land income tax and expect to have the right to a full

ight to a full refund of all income tax withheld

efund of all income tax withheld.

( (This in

This includes seasonal and student empl

ludes seasonal and student employees whose annual income wi

ees whose annual income will be bel

l be below the mini

w the minimum filing

um filing requi

equirements)

ements).

If both a and b app

If both a and b apply, enter year appli

enter year applicable _______ (year effective) Enter

able _______ (year effective) Enter “EXEMPT

PT” he here. . . . . . . . . . . . . .

e. . . . . . . . . . . . . .

3.________________

3.________________

4. I I claim exemption f

laim exemption fro rom withholding be

m withholding because I am domiciled in one of the foll

ause I am domiciled in one of the following states

wing states. Che

Check state that applies.

k state that applies.

Virginia

irginia

I fu

I further ce

ther certify that I do not maintain a place of abode in Ma

tify that I do not maintain a place of abode in Maryland as desc

land as described in the inst

ibed in the instructi

uctions above.

ns above.

Enter

Enter “EXEMPT” he here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.________________

4.________________

5. 5. I claim exemption from Maryland

I claim exemption from Maryland state

state withholding because I am domiciled in the Commonwealth of Pennsylvania

withholding because I am domiciled in the Commonwealth of Pennsylvania

and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507.

and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507.

Enter “EXEMPT” here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter “EXEMPT” here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. I claim exemption from Maryland

6. I claim exemption from Maryland local

local tax because I live in a local Pennysylvania jurisdiction within York or

tax because I live in a local Pennysylvania jurisdiction within York or

Adams counties. Enter “EXEMPT” here and on line 4 of Form MW507. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Adams counties. Enter “EXEMPT” here and on line 4 of Form MW507. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.________________

6.________________

7. I claim exemption from Maryland

7. I claim exemption from Maryland local

local tax because I live in a local Pennsylvania jurisdiction that does not impose

tax because I live in a local Pennsylvania jurisdiction that does not impose

an earnings or income tax on Maryland residents. Enter “EXEMPT” here and on line 4 of Form MW507. . . . . .

an earnings or income tax on Maryland residents. Enter “EXEMPT” here and on line 4 of Form MW507. . . . . .

7.________________

7.________________

8. I certify that I am a legal resident of the state of ____________ and am not subject to Maryland withholding because

8. I certify that I am a legal resident of the state of ____________ and am not subject to Maryland withholding because

l meet the requirements set forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses

l meet the requirements set forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses

Residency Relief Act. Enter “EXEMPT” here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Residency Relief Act. Enter “EXEMPT” here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.________________

8.________________

Section 4 - Employee

ection 4 - Employee Signature

nature

Under penalties of perju

Under penalties of perjury, I de

I decla lare that I have examined this ce

e that I have examined this certifi

tificate and to the best of my kn

ate and to the best of my knowledge and belie

wledge and belief, it is t

it is true, cor

correct

ect, and complete

and complete. I I

fu further ce

ther certify that I am entitled to the number of withholding all

tify that I am entitled to the number of withholding allowances

wances claimed on line 1 ab

laimed on line 1 above, or if

or if claiming exemption fr

laiming exemption from withholdin

om withholding, that I am

that I am

entitled to

entitled to claim the exempt status on which

laim the exempt status on whicheverline(s) I completed.

verline(s) I completed.

Empl

Employe yee’s si

s signature

nature

Date_________________________

Date_________________________

(Form is not valid

orm is not valid unless

unless you sign it.) __________________________________________________________________

ou sign it.) __________________________________________________________________

Employer’s name and address (including zip code) (For employer use only)

Employer’s name and address (including zip code) (For employer use only)

Federal Employer identification number

Federal Employer identification number

Central Payroll Bureau

Central Payroll Bureau

52-6002033

52-6002033

P.O. Box 2396

P.O. Box 2396

(For State of Maryland - CPB use only)

(For State of Maryland - CPB use only)

Annapolis, MD 21404

Annapolis, MD 21404

Impo

Important

tant: The info

e informa

mation

ion you supp

ou supply y must be complete

ust be complete. This fo

is form wi

m will replace in total a

l replace in total any ce

y certifi ificate

ate you pr

ou previous

viously submit

y submit ted.

ted.

Web eb Site -

ite - omp.state.md.us/cpb

.state.md.us/cpb

1

1