Form 38.18 - Promissory Note And Mortgage; Escrow Agreement

ADVERTISEMENT

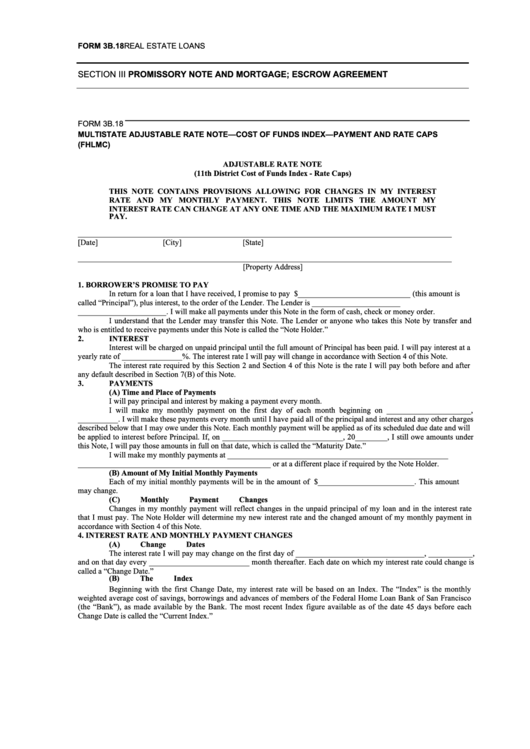

FORM 3B.18

REAL ESTATE LOANS

SECTION III

PROMISSORY NOTE AND MORTGAGE; ESCROW AGREEMENT

_______________________________________________________________________________

FORM 3B.18

MULTISTATE ADJUSTABLE RATE NOTE—COST OF FUNDS INDEX—PAYMENT AND RATE CAPS

(FHLMC)

ADJUSTABLE RATE NOTE

(11th District Cost of Funds Index - Rate Caps)

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST

RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY

INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST

PAY.

[Date]

[City]

[State]

[Property Address]

1.

BORROWER’S PROMISE TO PAY

In return for a loan that I have received, I promise to pay U.S. $____________________________ (this amount is

called “Principal”), plus interest, to the order of the Lender. The Lender is ______________________

______________________. I will make all payments under this Note in the form of cash, check or money order.

I understand that the Lender may transfer this Note. The Lender or anyone who takes this Note by transfer and

who is entitled to receive payments under this Note is called the “Note Holder.”

2.

INTEREST

Interest will be charged on unpaid principal until the full amount of Principal has been paid. I will pay interest at a

yearly rate of _______________%. The interest rate I will pay will change in accordance with Section 4 of this Note.

The interest rate required by this Section 2 and Section 4 of this Note is the rate I will pay both before and after

any default described in Section 7(B) of this Note.

3.

PAYMENTS

(A)

Time and Place of Payments

I will pay principal and interest by making a payment every month.

I will make my monthly payment on the first day of each month beginning on _____________________,

__________. I will make these payments every month until I have paid all of the principal and interest and any other charges

described below that I may owe under this Note. Each monthly payment will be applied as of its scheduled due date and will

be applied to interest before Principal. If, on ______________________________, 20________, I still owe amounts under

this Note, I will pay those amounts in full on that date, which is called the “Maturity Date.”

I will make my monthly payments at _______________________________________________________

________________________________________________ or at a different place if required by the Note Holder.

(B)

Amount of My Initial Monthly Payments

Each of my initial monthly payments will be in the amount of U.S. $________________________. This amount

may change.

(C)

Monthly Payment Changes

Changes in my monthly payment will reflect changes in the unpaid principal of my loan and in the interest rate

that I must pay. The Note Holder will determine my new interest rate and the changed amount of my monthly payment in

accordance with Section 4 of this Note.

4.

INTEREST RATE AND MONTHLY PAYMENT CHANGES

(A)

Change Dates

The interest rate I will pay may change on the first day of ________________________________, ___________,

and on that day every _________________________ month thereafter. Each date on which my interest rate could change is

called a “Change Date.”

(B)

The Index

Beginning with the first Change Date, my interest rate will be based on an Index. The “Index” is the monthly

weighted average cost of savings, borrowings and advances of members of the Federal Home Loan Bank of San Francisco

(the “Bank”), as made available by the Bank. The most recent Index figure available as of the date 45 days before each

Change Date is called the “Current Index.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1 2

2 3

3