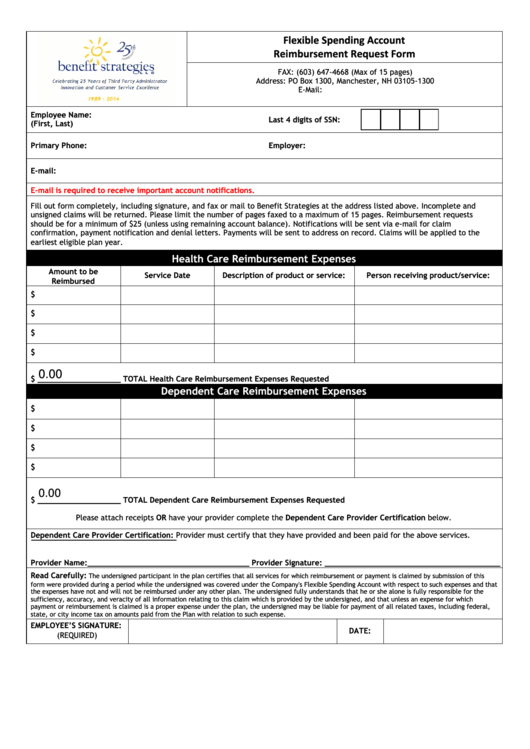

Flexible Spending Account

Reimbursement Request Form

FAX: (603) 647-4668 (Max of 15 pages)

Address: PO Box 1300, Manchester, NH 03105-1300

E-Mail:

Employee Name:

Last 4 digits of SSN:

(First, Last)

Primary Phone:

Employer:

E-mail:

E-mail is required to receive important account notifications.

Fill out form completely, including signature, and fax or mail to Benefit Strategies at the address listed above. Incomplete and

unsigned claims will be returned. Please limit the number of pages faxed to a maximum of 15 pages. Reimbursement requests

should be for a minimum of $25 (unless using remaining account balance). Notifications will be sent via e-mail for claim

confirmation, payment notification and denial letters. Payments will be sent to address on record. Claims will be applied to the

earliest eligible plan year.

Health Care Reimbursement Expenses

Amount to be

Service Date

Description of product or service:

Person receiving product/service:

Reimbursed

$

$

$

$

0.00

$ __________________ TOTAL Health Care Reimbursement Expenses Requested

Dependent Care Reimbursement Expenses

$

$

$

$

0.00

$ __________________ TOTAL Dependent Care Reimbursement Expenses Requested

Please attach receipts OR have your provider complete the Dependent Care Provider Certification below.

Dependent Care Provider Certification: Provider must certify that they have provided and been paid for the above services.

Provider Name:___________________________________ Provider Signature: ______________________________________

Read Carefully:

The undersigned participant in the plan certifies that all services for which reimbursement or payment is claimed by submission of this

form were provided during a period while the undersigned was covered under the Company's Flexible Spending Account with respect to such expenses and that

the expenses have not and will not be reimbursed under any other plan. The undersigned fully understands that he or she alone is fully responsible for the

sufficiency, accuracy, and veracity of all information relating to this claim which is provided by the undersigned, and that unless an expense for which

payment or reimbursement is claimed is a proper expense under the plan, the undersigned may be liable for payment of all related taxes, including federal,

state, or city income tax on amounts paid from the Plan with relation to such expense.

EMPLOYEE’S SIGNATURE:

DATE:

(REQUIRED)

1

1 2

2