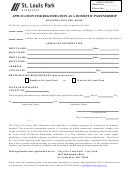

Application For Registration As A Self-Employed Person (S1) Page 2

ADVERTISEMENT

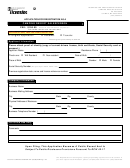

Do you have any business partners?

Can you engage employees at your own expense if

required?

Yes

No

Yes

No

If you have business partners they must also register as

Do you risk your own money?

individuals for Social Insurance and Income Tax

Yes

No

Business partner’s full name and address

Do you provide the main items of equipment you need for

your job, not just the small tools many employees provide for

themselves?

Yes

No

Do you agree to do a job for a fixed price regardless of how

If you have more than one partner please write their names and

long the job may take?

addresses on a separate sheet of paper and send it to us with

Yes

No

this form.

If you are employing someone to work for

Are you willing to offer your services to anyone who

you

approaches you?

If you are employing, or thinking of employing someone to work

Yes

No

for you, you also need to register your business for PAYE

purposes. Please contact PAYE section in writing or call

telephone No. 20074924 for further information.

Social Insurance option for self- employed

Employed or Self-Employed

women

Generally, you are –

Under the Social Security (Insurance) Act a self-employed

Self-employed if you are in business on your own account and

woman may apply for maternity allowance with effect from 24

bear the responsibility for the success or failure of that business,

July 2014. If you want to opt to pay the “additional voluntary

and

contribution” to be able to claim this allowance, please tick

Employed if you are a director of the company from which you

this box

are receiving income or if you work under the control of someone

Note: If you opt to pay the “additional voluntary contribution”

and do not run the risks of having a business yourself.

you must maintain the payment of this contribution during the

In order to ascertain whether or not you classify as a self-

whole of your self-employed working life.

employed person you need to answer the following questions:

Documentation Required

Do you work a set amount of hours?

Yes

No

Please supply a copy of the following documents when

handing in this application:

What hours do you work and who decides these hours?

Business Name Registration (if applicable)

Are you paid by the hour, week or month?

Passport or Identity Card

Trade Licence (if required)

Can you get overtime pay or bonus payment?

Yes

No

Declaration

Can someone tell you at any time what to do, where to carry out

the work and when or how to do it?

I declare that to the best of my knowledge and

Yes

No

belief the particulars given on this form are correct

and complete.

Does anyone have the right to select, suspend or dismiss you

Signed:_______________________

from your business?

Date:_________________________

Yes

No

Once the Ministry of Employment approves your registration,

Please allow at least 5 working days for this office to consider this

the Income Tax Office will send you via mail a pack

application. Unless you hear from us within this period, you are

containing all necessary documents.

then required to register at the Ministry of Employment.

FOR OFFICIAL USE ONLY

Reason for none approval__________________________

Taxpayer Ref.___________________________

Officer’s Signature___________________________________

Social Insurance Code________________

Date_______________________

Application approved

Yes/No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2