Entity Tax Self-Certification Form

ADVERTISEMENT

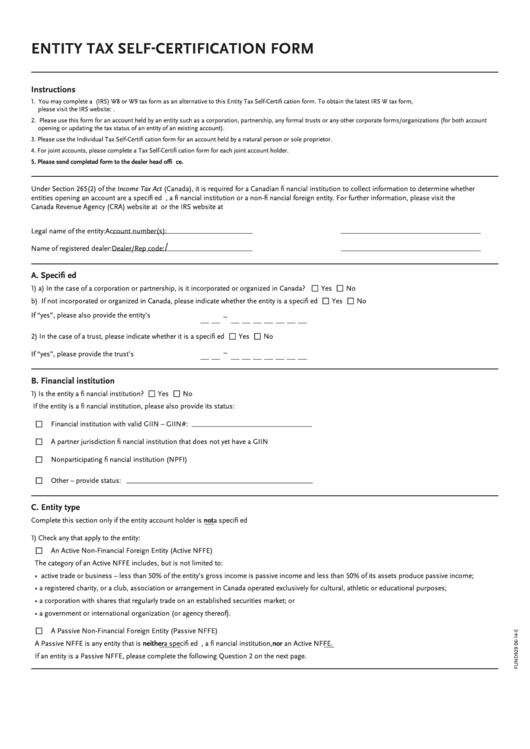

ENTITY TAX SELF-CERTIFICATION FORM

Instructions

1. You may complete a U.S. Internal Revenue Service (IRS) W8 or W9 tax form as an alternative to this Entity Tax Self-Certifi cation form. To obtain the latest IRS W tax form,

please visit the IRS website:

2. Please use this form for an account held by an entity such as a corporation, partnership, any formal trusts or any other corporate forms/organizations (for both account

opening or updating the tax status of an entity of an existing account).

3. Please use the Individual Tax Self-Certifi cation form for an account held by a natural person or sole proprietor.

4. For joint accounts, please complete a Tax Self-Certifi cation form for each joint account holder.

5. Please send completed form to the dealer head offi ce.

Under Section 265(2) of the Income Tax Act (Canada), it is required for a Canadian fi nancial institution to collect information to determine whether

entities opening an account are a specifi ed U.S. person, a fi nancial institution or a non-fi nancial foreign entity. For further information, please visit the

Canada Revenue Agency (CRA) website at or the IRS website at

Legal name of the entity:

Account number(s):

/

Name of registered dealer:

Dealer/Rep code:

A. Specifi ed U.S. person

▫

▫

1) a) In the case of a corporation or partnership, is it incorporated or organized in Canada?

Yes

No

▫

▫

b) If not incorporated or organized in Canada, please indicate whether the entity is a specifi ed U.S. person.

Yes

No

If “yes”, please also provide the entity’s U.S. TIN

–

▫

▫

2) In the case of a trust, please indicate whether it is a specifi ed U.S. person.

Yes

No

–

If “yes”, please provide the trust’s U.S. TIN

B. Financial institution

▫

▫

1) Is the entity a fi nancial institution?

Yes

No

If the entity is a fi nancial institution, please also provide its status:

▫

Financial institution with valid GIIN – GIIN#: _________________________________

▫

A partner jurisdiction fi nancial institution that does not yet have a GIIN

▫

Nonparticipating fi nancial institution (NPFI)

▫

Other – provide status: ___________________________________________________

C. Entity type

Complete this section only if the entity account holder is not a specifi ed U.S. person or a fi nancial institution.

1) Check any that apply to the entity:

▫

An Active Non-Financial Foreign Entity (Active NFFE)

The category of an Active NFFE includes, but is not limited to:

• active trade or business – less than 50% of the entity’s gross income is passive income and less than 50% of its assets produce passive income;

• a registered charity, or a club, association or arrangement in Canada operated exclusively for cultural, athletic or educational purposes;

• a corporation with shares that regularly trade on an established securities market; or

• a government or international organization (or agency thereof).

▫

A Passive Non-Financial Foreign Entity (Passive NFFE)

A Passive NFFE is any entity that is neither a specifi ed U.S. person, a fi nancial institution, nor an Active NFFE.

If an entity is a Passive NFFE, please complete the following Question 2 on the next page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4