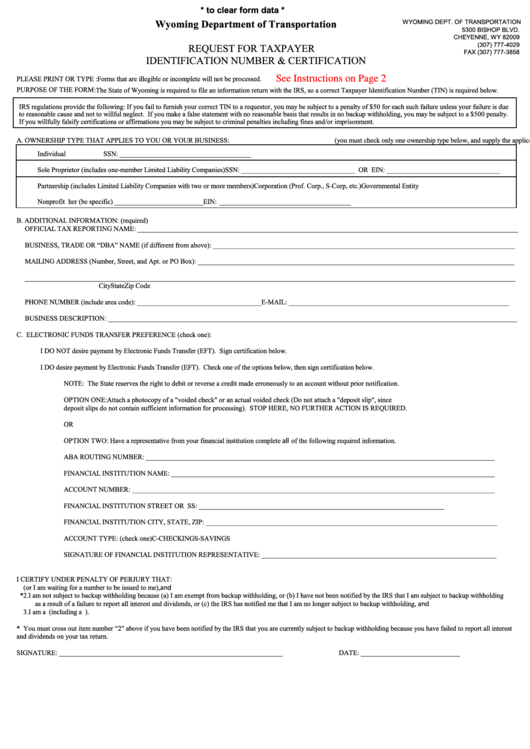

* click here to clear form data *

Wyoming Department of Transportation

WYOMING DEPT. OF TRANSPORTATION

5300 BISHOP BLVD.

CHEYENNE, WY 82009

(307) 777-4029

REQUEST FOR TAXPAYER

FAX (307) 777-3858

IDENTIFICATION NUMBER & CERTIFICATION

PLEASE PRINT O R TYPE :

Forms that are illegible or incomplete will not be processed.

See Instructions on Page 2

PURPOSE OF THE FORM :

The State of Wyoming is required to file an information return with the IRS, so a correct Taxpayer Identification Number (TIN) is required below.

IRS regulations provide the following: If you fail to furnish your correct TIN to a requestor, you may be subject to a penalty of $50 for each such failure unless your failure is due

to reasonable cause and not to willful neglect. If you make a false statement with no reasonable basis that results in no backup withholding, you may be subject to a $500 penalty.

If you willfully falsify certifications or affirmations you may be subject to criminal penalties including fines and/or imprisonment.

A. OWNERSHIP TYPE THAT APPLIES TO YOU OR YOUR BUSINESS: (you must check only one owner ship type below, and supply the applicable SSN or EIN )

Individual

SSN: _____________________________________

Sole Proprietor (includes one-member Limited Liability Companies) SSN: ________________________________ OR EIN: ________________________________

Partnership (includes Limited Liability Companies with two or more members)

Corporation (Prof. Corp., S-Corp, etc.)

Governmental Entity

Nonprofit Corp.

Trust

Other (be specific) _________________________

EIN: _____________________________________

B. ADDITIONAL INFORMATION: (required)

OFFICIAL TAX REPORTING NAME: ___________________________________________________________________________________________________________

BUSINESS, TRADE OR “DBA” NAME (if different from above): _____________________________________________________________________________________

MAILING ADDRESS (Number, Street, and Apt. or PO Box): _________________________________________________________________________________________

__________________________________________________________________________________________________________________________________________

City

State

Zip Code

PHONE NUMBER (include area code): ___________________________________ E-MAIL: ______________________________________________________________

BUSINESS DESCRIPTION: ___________________________________________________________________________________________________________________

C. ELECTRONIC FUNDS TRANSFER PREFERENCE (check one):

I DO NOT desire payment by Electronic Funds Transfer (EFT). Sign certification below.

I DO desire payment by Electronic Funds Transfer (EFT). Check one of the options below, then sign certification below.

NOTE: The State reserves the right to debit or reverse a credit made erroneously to an account without prior notification.

OPTION ONE: Attach a photocopy of a "voided check" or an actual voided check (Do not attach a "deposit slip", since

deposit slips do not contain sufficient information for processing). STOP HERE, NO FURTHER ACTION IS REQUIRED.

OR

OPTION TWO: Have a representative from your financial institution complete all of the following required information.

ABA ROUTING NUMBER: __________________________________________________________________________________________________

FINANCIAL INSTITUTION NAME: ___________________________________________________________________________________________

ACCOUNT NUMBER: ______________________________________________________________________________________________________

FINANCIAL INSTITUTION STREET OR P.O. BOX ADDRESS: _____________________________________________________________________

FINANCIAL INSTITUTION CITY, STATE, ZIP: __________________________________________________________________________________

ACCOUNT TYPE: (check one)

C-CHECKING

S-SAVINGS

SIGNATURE OF FINANCIAL INSTITUTION REPRESENTATIVE: __________________________________________________________________

I CERTIFY UNDER PENALTY OF PERJURY THAT:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

*2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the IRS that I am subject to backup withholding

as a result of a failure to report all interest and dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3. I am a U.S. person (including a U.S. resident alien).

* You must cross out item number “2" above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest

and dividends on your tax return.

SIGNATURE: _______________________________________________________________

DATE: ____________________________

1

1 2

2