Tax Filing Status And Confirmation Of Income

ADVERTISEMENT

Financial Aid and Scholarships Office

Tel: 760.750.4850

Fax: 760.750.3047

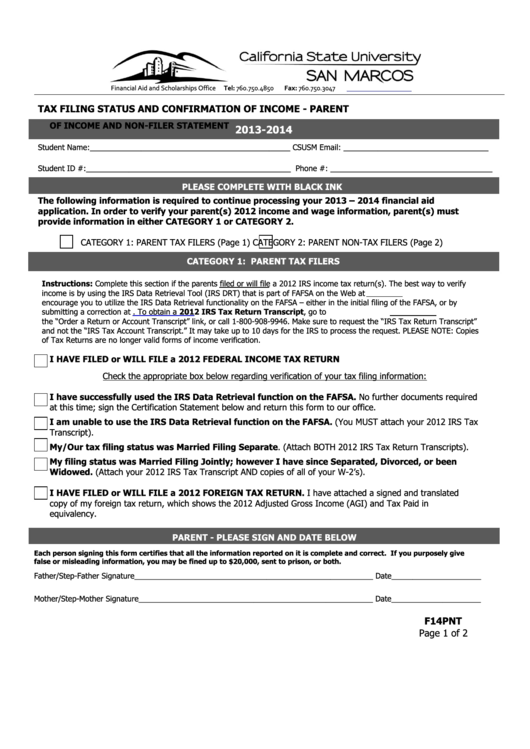

TAX FILING STATUS AND CONFIRMATION OF INCOME - PARENT

OF INCOME AND NON-FILER STATEMENT

2013-2014

Student Name:_______________________________________________ CSUSM Email: __________________________________

Student ID #:________________________________________________ Phone #: ______________________________________

PLEASE COMPLETE WITH BLACK INK

The following information is required to continue processing your 2013 – 2014 financial aid

application. In order to verify your parent(s) 2012 income and wage information, parent(s) must

provide information in either CATEGORY 1 or CATEGORY 2.

CATEGORY 1: PARENT TAX FILERS (Page 1)

CATEGORY 2: PARENT NON-TAX FILERS (Page 2)

CATEGORY 1: PARENT TAX FILERS

Instructions: Complete this section if the parents filed or will file a 2012 IRS income tax return(s). The best way to verify

income is by using the IRS Data Retrieval Tool (IRS DRT) that is part of FAFSA on the Web at FAFSA.gov. We strongly

encourage you to utilize the IRS Data Retrieval functionality on the FAFSA – either in the initial filing of the FAFSA, or by

submitting a correction at To obtain a 2012 IRS Tax Return Transcript, go to and click on

the “Order a Return or Account Transcript” link, or call 1-800-908-9946. Make sure to request the “IRS Tax Return Transcript”

and not the “IRS Tax Account Transcript.” It may take up to 10 days for the IRS to process the request. PLEASE NOTE: Copies

of Tax Returns are no longer valid forms of income verification.

I HAVE FILED or WILL FILE a 2012 FEDERAL INCOME TAX RETURN

Check the appropriate box below regarding verification of your tax filing information:

I have successfully used the IRS Data Retrieval function on the FAFSA. No further documents required

at this time; sign the Certification Statement below and return this form to our office.

I am unable to use the IRS Data Retrieval function on the FAFSA. (You MUST attach your 2012 IRS Tax

Transcript).

My/Our tax filing status was Married Filing Separate. (Attach BOTH 2012 IRS Tax Return Transcripts).

My filing status was Married Filing Jointly; however I have since Separated, Divorced, or been

Widowed. (Attach your 2012 IRS Tax Transcript AND copies of all of your W-2’s).

I HAVE FILED or WILL FILE a 2012 FOREIGN TAX RETURN. I have attached a signed and translated

copy of my foreign tax return, which shows the 2012 Adjusted Gross Income (AGI) and Tax Paid in U.S. dollar

equivalency.

PARENT - PLEASE SIGN AND DATE BELOW

Each person signing this form certifies that all the information reported on it is complete and correct. If you purposely give

false or misleading information, you may be fined up to $20,000, sent to prison, or both.

Father/Step-Father Signature________________________________________________________ Date_____________________

Mother/Step-Mother Signature_______________________________________________________ Date_____________________

F14PNT

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2