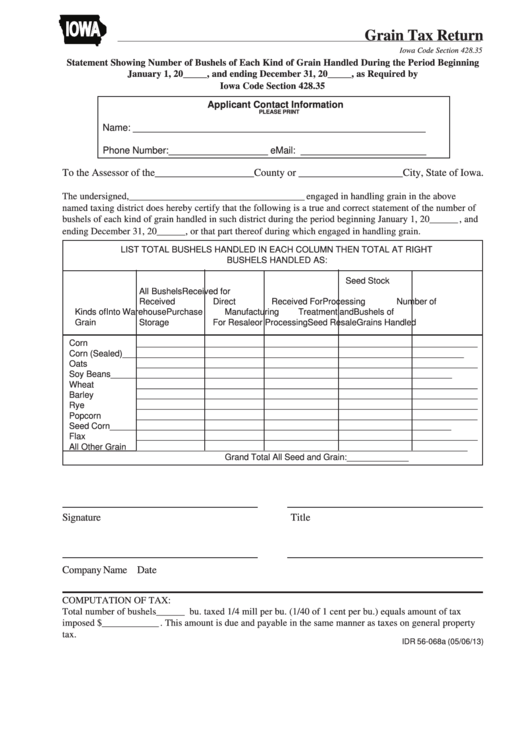

IOWA

Grain Tax Return

Iowa Code Section 428.35

Statement Showing Number of Bushels of Each Kind of Grain Handled During the Period Beginning

January 1, 20_____, and ending December 31, 20_____, as Required by

Iowa Code Section 428.35

Applicant Contact Information

PLEASE PRINT

Name: ________________________________________________________

Phone Number:___________________ eMail: ________________________

To the Assessor of the ___________________County or ____________________City, State of Iowa.

The undersigned, _____________________________________ engaged in handling grain in the above

named taxing district does hereby certify that the following is a true and correct statement of the number of

bushels of each kind of grain handled in such district during the period beginning January 1, 20 ______ , and

ending December 31, 20______, or that part thereof during which engaged in handling grain.

LIST TOTAL BUSHELS HANDLED IN EACH COLUMN THEN TOTAL AT RIGHT

BUSHELS HANDLED AS:

Seed Stock

All Bushels

Received for

Received

Direct

Received For

Processing

Number of

Kinds of

Into Warehouse

Purchase

Manufacturing

Treatment and

Bushels of

Grain

Storage

For Resale

or Processing

Seed Resale

Grains Handled

Corn

________________________________________________________________________

Corn (Sealed)

________________________________________________________________________

Oats

________________________________________________________________________

Soy Beans

________________________________________________________________________

Wheat

________________________________________________________________________

Barley

________________________________________________________________________

Rye

________________________________________________________________________

Popcorn

________________________________________________________________________

Seed Corn

________________________________________________________________________

Flax

________________________________________________________________________

All Other Grain

________________________________________________________________________

Grand Total All Seed and Grain: _____________

Signature

Title

Company Name

Date

COMPUTATION OF TAX:

Total number of bushels ______ bu. taxed 1/4 mill per bu. (1/40 of 1 cent per bu.) equals amount of tax

imposed $ ____________ . This amount is due and payable in the same manner as taxes on general property

tax.

IDR 56-068a (05/06/13)

1

1 2

2