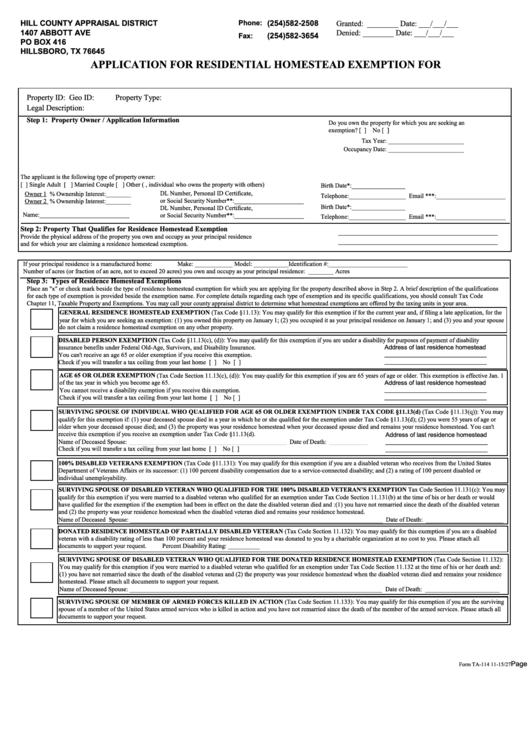

Application For Residential Homestead Exemption For

ADVERTISEMENT

HILL COUNTY APPRAISAL DISTRICT

Phone:

(254)582-2508

Granted: ________

Date: ___/___/___

1407 ABBOTT AVE

Denied: ________

Date: ___/___/___

(254)582-3654

Fax:

PO BOX 416

HILLSBORO, TX 76645

APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION FOR

Property ID:

Property Type:

Geo ID:

Legal Description:

Step 1: Property Owner / Application Information

Do you own the property for which you are seeking an

exemption?..................Yes [ ] No [ ]

Tax Year: ________________________

Occupancy Date: ________________________

The applicant is the following type of property owner:

[ ] Single Adult [ ] Married Couple [ ] Other (e.g., individual who owns the property with others)

Birth Date*:_________________

DL Number, Personal ID Certificate,

Owner 1 % Ownership Interest:________

Telephone:__________________ Email ***:______________________

or Social Security Number**:______________________

Owner 2 % Ownership Interest:________

Birth Date*:_________________

DL Number, Personal ID Certificate,

Name:_____________________________

or Social Security Number**:______________________

Telephone:__________________ Email ***:______________________

Step 2: Property That Qualifies for Residence Homestead Exemption

_________________________________________

Provide the physical address of the property you own and occupy as your principal residence

_________________________________________

and for which your are claiming a residence homestead exemption.

If your principal residence is a manufactured home:

Make: ____________ Model: ___________Identification #:_________________________

Number of acres (or fraction of an acre, not to exceed 20 acres) you own and occupy as your principal residence: ________ Acres

Step 3: Types of Residence Homestead Exemptions

Place an "x" or check mark beside the type of residence homestead exemption for which you are applying for the property described above in Step 2. A brief description of the qualifications

for each type of exemption is provided beside the exemption name. For complete details regarding each type of exemption and its specific qualifications, you should consult Tax Code

Chapter 11, Taxable Property and Exemptions. You may call your county appraisal district to determine what homestead exemptions are offered by the taxing units in your area.

GENERAL RESIDENCE HOMESTEAD EXEMPTION (Tax Code §11.13): You may qualify for this exemption if for the current year and, if filing a late application, for the

year for which you are seeking an exemption: (1) you owned this property on January 1; (2) you occupied it as your principal residence on January 1; and (3) you and your spouse

do not claim a residence homestead exemption on any other property.

DISABLED PERSON EXEMPTION (Tax Code §11.13(c), (d)): You may qualify for this exemption if you are under a disability for purposes of payment of disability

Address of last residence homestead

insurance benefits under Federal Old-Age, Survivors, and Disability Insurance.

______________________________

You can't receive an age 65 or older exemption if you receive this exemption.

______________________________

Check if you will transfer a tax ceiling from your last home ......................Yes [ ] No [ ]

AGE 65 OR OLDER EXEMPTION (Tax Code Section 11.13(c), (d)): You may qualify for this exemption if you are 65 years of age or older. This exemption is effective Jan. 1

Address of last residence homestead

of the tax year in which you become age 65.

______________________________

You cannot receive a disability exemption if you receive this exemption.

______________________________

Check if you will transfer a tax ceiling from your last home ......................Yes [ ] No [ ]

SURVIVING SPOUSE OF INDIVIDUAL WHO QUALIFIED FOR AGE 65 OR OLDER EXEMPTION UNDER TAX CODE §11.13(d) (Tax Code §11.13(q)): You may

qualify for this exemption if: (1) your deceased spouse died in a year in which he or she qualified for the exemption under Tax Code §11.13(d); (2) you were 55 years of age or

older when your deceased spouse died; and (3) the property was your residence homestead when your deceased spouse died and remains your residence homestead. You can't

receive this exemption if you receive an exemption under Tax Code §11.13(d).

Address of last residence homestead

Name of Deceased Spouse: __________________________________________________ Date of Death: _____________

______________________________

______________________________

Check if you will transfer a tax ceiling from your last home ......................Yes [ ] No [ ]

100% DISABLED VETERANS EXEMPTION (Tax Code §11.131): You may qualify for this exemption if you are a disabled veteran who receives from the United States

Department of Veterans Affairs or its successor: (1) 100 percent disability compensation due to a service-connected disability; and (2) a rating of 100 percent disabled or

individual unemployability.

SURVIVING SPOUSE OF DISABLED VETERAN WHO QUALIFIED FOR THE 100% DISABLED VETERAN’S EXEMPTION Tax Code Section 11.131(c): You may

qualify for this exemption if you were married to a disabled veteran who qualified for an exemption under Tax Code Section 11.131(b) at the time of his or her death or would

have qualified for the exemption if the exemption had been in effect on the date the disabled veteran died and :(1) you have not remarried since the death of the disabled veteran

and (2) the property was your residence homestead when the disabled veteran died and remains your residence homestead.

Name of Deceased Spouse: ________________________________________________________________________________ Date of Death: __________________________

DONATED RESIDENCE HOMESTEAD OF PARTIALLY DISABLED VETERAN (Tax Code Section 11.132): You may qualify for this exemption if you are a disabled

veteran with a disability rating of less than 100 percent and your residence homestead was donated to you by a charitable organization at no cost to you. Please attach all

documents to support your request.

Percent Disability Rating: __________

SURVIVING SPOUSE OF DISABLED VETERAN WHO QUALIFIED FOR THE DONATED RESIDENCE HOMESTEAD EXEMPTION (Tax Code Section 11.132):

You may qualify for this exemption if you were married to a disabled veteran who qualified for an exemption under Tax Code Section 11.132 at the time of his or her death and:

(1) you have not remarried since the death of the disabled veteran and (2) the property was your residence homestead when the disabled veteran died and remains your residence

homestead. Please attach all documents to support your request.

Name of Deceased Spouse: ________________________________________________________________________________ Date of Death: _________________________

SURVIVING SPOUSE OF MEMBER OF ARMED FORCES KILLED IN ACTION (Tax Code Section 11.133): You may qualify for this exemption if you are the surviving

spouse of a member of the United States armed services who is killed in action and you have not remarried since the death of the member of the armed services. Please attach all

documents to support your request.

Page 1 of 4

Form TA-114 11-15/27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4