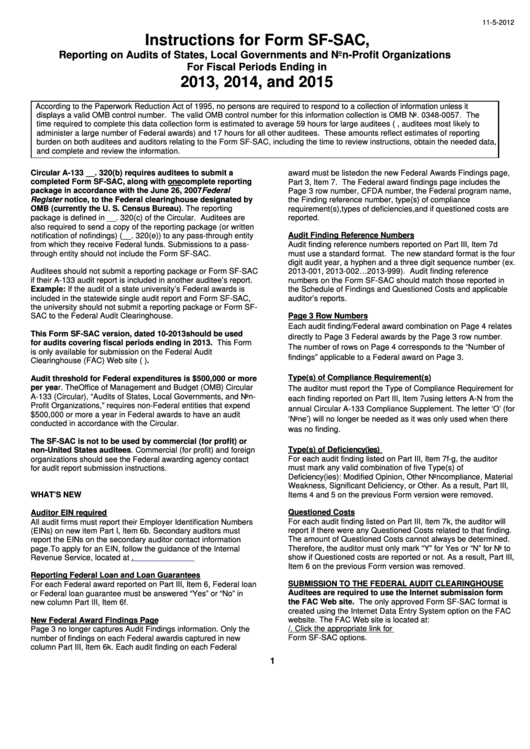

Instructions For Form Sf-Sac

ADVERTISEMENT

11-5-2012

Instructions for Form SF-SAC,

Reporting on Audits of States, Local Governments and Non-Profit Organizations

For Fiscal Periods Ending in

2013, 2014, and 2015

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it

displays a valid OMB control number. The valid OMB control number for this information collection is OMB No. 0348-0057. The

time required to complete this data collection form is estimated to average 59 hours for large auditees (i.e., auditees most likely to

administer a large number of Federal awards) and 17 hours for all other auditees. These amounts reflect estimates of reporting

burden on both auditees and auditors relating to the Form SF-SAC, including the time to review instructions, obtain the needed data,

and complete and review the information.

Circular A-133 __. 320(b) requires auditees to submit a

award must be listed on the new Federal Awards Findings page,

completed Form SF-SAC, along with one complete reporting

Part 3, Item 7. The Federal award findings page includes the

package in accordance with the June 26, 2007Federal

Page 3 row number, CFDA number, the Federal program name,

Register notice, to the Federal clearinghouse designated by

the Finding reference number, type(s) of compliance

OMB (currently the U. S. Census Bureau). The reporting

requirement(s), types of deficiencies, and if questioned costs are

package is defined in __. 320(c) of the Circular. Auditees are

reported.

also required to send a copy of the reporting package (or written

Audit Finding Reference Numbers

notification of no findings) (__. 320(e)) to any pass-through entity

from which they receive Federal funds. Submissions to a pass-

Audit finding reference numbers reported on Part III, Item 7d

through entity should not include the Form SF-SAC.

must use a standard format. The new standard format is the four

digit audit year, a hyphen and a three digit sequence number (ex.

Auditees should not submit a reporting package or Form SF-SAC

2013-001, 2013-002…2013-999). Audit finding reference

if their A-133 audit report is included in another auditee’s report.

numbers on the Form SF-SAC should match those reported in

Example: If the audit of a state university’s Federal awards is

the Schedule of Findings and Questioned Costs and applicable

included in the statewide single audit report and Form SF-SAC,

auditor’s reports.

the university should not submit a reporting package or Form SF-

Page 3 Row Numbers

SAC to the Federal Audit Clearinghouse.

Each audit finding/Federal award combination on Page 4 relates

This Form SF-SAC version, dated 10-2013 should be used

directly to Page 3 Federal awards by the Page 3 row number.

for audits covering fiscal periods ending in 2013. This Form

The number of rows on Page 4 corresponds to the “Number of

is only available for submission on the Federal Audit

findings” applicable to a Federal award on Page 3.

Clearinghouse (FAC) Web site ( ).

Type(s) of Compliance Requirement(s)

Audit threshold for Federal expenditures is $500,000 or more

per year. The Office of Management and Budget (OMB) Circular

The auditor must report the Type of Compliance Requirement for

A-133 (Circular), “Audits of States, Local Governments, and Non-

each finding reported on Part III, Item 7using letters A-N from the

Profit Organizations,” requires non-Federal entities that expend

annual Circular A-133 Compliance Supplement. The letter ‘O’ (for

$500,000 or more a year in Federal awards to have an audit

‘None’) will no longer be needed as it was only used when there

conducted in accordance with the Circular.

was no finding.

The SF-SAC is not to be used by commercial (for profit) or

Type(s) of Deficiency(ies)

non-United States auditees. Commercial (for profit) and foreign

For each audit finding listed on Part III, Item 7f-g, the auditor

organizations should see the Federal awarding agency contact

must mark any valid combination of five Type(s) of

for audit report submission instructions.

Deficiency(ies): Modified Opinion, Other Noncompliance, Material

Weakness, Significant Deficiency, or Other. As a result, Part III,

WHAT’S NEW

Items 4 and 5 on the previous Form version were removed.

Questioned Costs

Auditor EIN required

For each audit finding listed on Part III, Item 7k, the auditor will

All audit firms must report their Employer Identification Numbers

report if there were any Questioned Costs related to that finding.

(EINs) on new item Part I, Item 6b. Secondary auditors must

The amount of Questioned Costs cannot always be determined.

report the EINs on the secondary auditor contact information

Therefore, the auditor must only mark “Y” for Yes or “N” for No to

page. To apply for an EIN, follow the guidance of the Internal

show if Questioned costs are reported or not. As a result, Part III,

Revenue Service, located at

Item 6 on the previous Form version was removed.

Reporting Federal Loan and Loan Guarantees

SUBMISSION TO THE FEDERAL AUDIT CLEARINGHOUSE

For each Federal award reported on Part III, Item 6, Federal loan

Auditees are required to use the Internet submission form

or Federal loan guarantee must be answered “Yes” or “No” in

the FAC Web site. The only approved Form SF-SAC format is

new column Part III, Item 6f.

created using the Internet Data Entry System option on the FAC

New Federal Award Findings Page

website. The FAC Web site is located at:

. Click the appropriate link for

Page 3 no longer captures Audit Findings information. Only the

Form SF-SAC options.

number of findings on each Federal award is captured in new

column Part III, Item 6k. Each audit finding on each Federal

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8