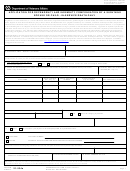

Recording requested by (name):

____________________________________________

When recorded mail to

and mail tax statements to:

____________________________________________

____________________________________________

____________________________________________

____________________________________________

Recorder’s Use Only

AFFIDAVIT-SURVIVING SPOUSE

Declaration of Exemption From Gov’t Code § 27388.1 Fee

OR DOMESTIC PARTNER

Transfer is exempt from fee per GC § 27388.1(a)(2):

recorded concurrently “in connection with” transfer subject to DTT

SUCCEEDING TO TITLE

recorded concurrently “in connection with” a transfer of

(Cal. Prob. § 13540)

residential dwelling to an owner-occupier

Transfer is exempt from fee per GC 27388.1(a)(1):

Assessor’s Parcel No. (APN):

Fee cap of $225.00 reached

Not related to real property

________________________________

____________________________________________, of legal age, being first duly sworn, deposes and says:

1. That ______________________________________, the decedent mentioned in the attached certified copy of

Certificate of Death, is the same person as _______________________________________, named as one of the parties

in that certain deed, dated ________________, executed by ______________________________________ to

_______________________________________________________________________________________ as

community property with right of survivorship, recorded as Instrument No. _______________________ in Book/Reel

___________, Page/Image ____________, of Official Records of _________________________________ County,

California, covering the following described property situated in the City of __________________________, County of

___________________________, California (insert legal description):

2. That he/she was married to, or the registered domestic partner of the decedent at the time of his/her death.

3. That the above-described property has been at all times since acquisition considered the community property of

him/her and decedent.

4. More than forty (40) days have passed since the death of the above-named decedent, and no notice has been

recorded pursuant to section 13541 of the Probate Code.

5. That, with respect to the above-described property, there has not been nor will there be an election filed pursuant to

Probate Code Sections 13502 or 13503 in any probate proceedings in any court of competent jurisdiction.

6. That the above-described property has not passed to someone other than the affiant under the decedent’s will or by

intestate succession.

7. That the property has not been disposed of in trust under the decedent’s will.

8. That the decedent’s will does not limit the affiant to a qualified ownership.

9. That this Affidavit is made for the protection and benefit of the surviving spouse, his/her successors, assigns and

personal representatives and all other parties hereafter dealing with or who may acquire an interest in the above-

described property.

Date:

_________________________

__________________________________________

Signature

__________________________________________

Print Name

1/24/18

1

1 2

2