Update: April 10, 2017

A separate form must be

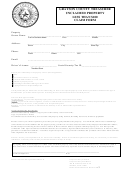

WASHINGTON COUNTY

used for each claimant.

TRAVEL CLAIM

Employee

Department

Date

Business

Destination

Purpose

EXPENDITURES (Expenses of this trip to be paid directly to others :)

$

* Registration Fees

Paid To:

$

* Lodging

Paid To:

$

* Air fare

Paid To:

* These items need full documentation, (i.e., a completed registration form, ticket, invoice, agenda, etc.)

PERSONAL AUTO MILES TRAVELED

___

Motor Pool Vehicle was Available: Yes ___

No

Date asked: ___________

Supervisor Initials: ______

DEPARTED FROM

DESTINATION

MILES

Personal Auto Total Miles Traveled:

0

$

Motor Pool AVAILABLE ($0.270 per mile reimbursement):

0.00

$

Motor Pool NOT AVAILABLE ($0.535 per mile reimbursement):

0.00

$

OR Fuel Receipts:

:

0.00

TOTAL MILEAGE OR FUEL RECEIPT REIMBURSEMENT AMOUNT

$

0.00

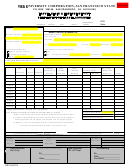

MEALS AND LODGING

TIME

TIME

GSA

DATE

DEPARTED

RETURNED

RATE

QTY

AMOUNT

BREAKFASTS

$

$

0.00

0

0.00

LUNCHES

$

$

0.00

0

0.00

DINNERS

$

$

0.00

0

0.00

General Services Administration (GSA)

LODGING

$

$

0.00

0

0.00

(Attach Detail List of Incidental Expenses)

INCIDENTALS

$

0.00

0

0.00

$

TOTAL MEALS, INCIDENTALS, & LODGING REIMBURSEMENT

0.00

TOTAL TRAVEL CLAIM REIMBURSEMENT

0.00

$

PER DIEM ALLOWANCE

IRS Code 9864- Sec 163

see

/

Leave at

Return at

Lodging:

Meal

or Before:

or After:

GSA Rate

Lodging without receipts: $40.00

Breakfast

7:00 am

9:00 am

$_______

0.00

Lunch

11:00 am

2:00 pm

$_______

UT Lodging Sales Tax Account is 10-4960-809000

0.00

Dinner

5:30 pm

8:00 pm

$_______

0.00

I certify that the amounts claimed are accurate and per County policy.

Name:

Account #

Signature

Address:

Department Head or Commission Designee Approval

1

1