AB CD

*2510300W101628*

PRINT FORM

RESET FORM

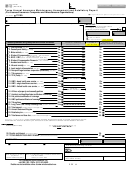

25-103

b.

(Rev.10-16/28)

b

Texas Annual Insurance Tax Report

(Independently Procured Insurance)

under Chapters 552 and 559, Government Code,

You have certain rights

to review, request and correct information we have on file about you.

Contact us at the address or phone number listed on this form.

71140

a. T Code

Type or print.

Do NOT write in shaded areas.

b

I

I

c. Taxpayer number

d. Filing period

e.

f. Due date

b

b

Taxpayer name and tax report mailing address (Make necessary name and address changes below.)

IMPORTANT

h.

g.

Blacken this box if your mailing address

has changed. Show changes beside the

1

preprinted information.

b

R

For Comptroller use only

i.PM

j.FM

k.NO Sch

1

b

b

b

Important Information Regarding Independently Procured Insurance

The Non-Admitted and Reinsurance Reform Act (NRRA) passed as part of the Dodd-Frank Wall Street Reform and Consumer Protection

Act in 2010. Texas laws that relate to independently procured insurance were revised to comply with the provisions of the NRRA that

became effective on July 21, 2011. The federal law defines independently procured insurance as insurance procured directly by an

insured from a nonadmitted insurer and provides that the home state of the insured controls for purposes of regulation and taxation. The

law also encourages the states to join a tax compact or agreement that would allow for the sharing of taxes due on policies that cover

risks in multiple states. Texas has not joined any compact or agreement at this time; however, if Texas joins a compact in the future,

additional information will be provided.

Who Must File: An insured whose home state is Texas and who procures insurance directly from a nonadmitted insurer, without an

agent's involvement, is liable for the independently procured tax on the policy.

Insureds whose policies were obtained through surplus lines agents/agencies, and who are no longer subject to this tax, should contact

the Comptroller's office at 1-800-252-1387 to discuss whether their account can be closed.

Refer to Publication 98-376, "Tax on Independently Procured Insurance," at and

to the instructions on the reverse side of this form for additional information.

Premium Tax Calculation

Your report cannot be processed without the supplement (Form 25-122).

I

1. Total premiums allocated to Texas (net of return premiums) from all supplements

("Premium" includes any premiums, membership fees, dues or

(Form 25-122)

other consideration for insurance.) (Whole dollars only)

.00

1.

b

2. Premium tax rate

.0485

2.

b

.

(Multiply Item 1 by Item 2)

3. Total tax due

3.

b

* * * Return this entire form.* * *

Form 25-103 (Rev.10-16/28)

.

(See instructions.)

4. Penalty and interest due

4.

.

(Item 3 plus Item 4)

5. TOTAL AMOUNT DUE AND PAYABLE

5.

b

Taxpayer name

AB

l.

m.

b

T Code

Taxpayer number

Period

b

b

b

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

71020

Authorized agent

Preparer's name (Type or print.)

Make the amount in Item 5

Mail to Comptroller of Public Accounts

payable to

P.O. Box 149356

Daytime phone

Date

State Comptroller

Austin, TX 78714-9356

(Area code & number)

For information about Insurance Tax, call 1-800-252-1387.

Details are also available online at

111 A

1

1 2

2