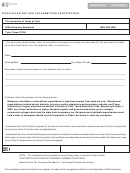

PRINT FORM

CLEAR FORM

01-924

(Rev.4-17/4)

Texas Agricultural Sales and Use Tax Exemption Certificate

Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying, leasing or renting

qualifying agricultural items they will use exclusively in the production of agricultural products for sale.

You cannot use this form to claim exemption from motor vehicle tax when buying motor vehicles, including trailers. To claim motor

vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber

Operations (Form 14-319) to the vehicle’s seller or dealer. You must also claim the exemption on the Application for Texas Title (Form

130-U) when titling or registering the vehicle with the local County Tax Assessor-Collector.

This form is not required when purchasing the following types of agricultural items:

• horses, mules and work animals commonly used in agricultural production;

• animal life, the products of which ordinarily constitute food for human consumption, such as cows, goats,

sheep, chickens, turkeys and pigs;

• feed for farm and ranch animals, including oats, corn, chicken scratch and hay; and

• seeds and annual plants, the products of which are commonly recognized as food for humans or animals

(such as corn, oats and soybeans) or are usually only raised to be sold in the regular course of business

(such as cotton seed).

All other purchases of agricultural items require this properly completed form to claim a sales tax exemption. See the back of this form for

examples of exempt and taxable items.

Name of retailer

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Proper use of this certificate

Purchasers - You can only use this certificate for items you purchase for exclusive use in an exempt manner. You

should be familiar with qualifying items. Any non-agricultural or personal use disqualifies the purchase from exemption.

See the back of this form for examples of exempt and taxable items.

Retailers - You can accept this certificate in good faith at the time of sale if it is properly completed with an ag/timber

number and expiration date. You can also accept it as a blanket certificate covering all sales made during the time this

certificate is valid on qualifying items that can reasonably be used to produce agriculture products for sale.

Name of purchaser

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Phone (Area code and number)

Ag/Timber number

Name of person to whom number is registered, if different than purchaser

Dec. 31, 2 0

This exemption certificate expires on

I understand that I am required to keep records to verify eligibility for the exemption(s) claimed and that I will be required to pay sales or

use tax on purchases that do not qualify for the exemption(s), in addition to any applicable interest and penalties.

I understand that it is a criminal offense to issue an exemption certificate to the seller for taxable items that I know will be used in a

manner that does not qualify for the exemptions found in Tax Code Section 151.316. The offense may range from a Class C misdemeanor

to a felony of the second degree.

Purchaser's signature

Purchaser's name (print or type)

Date

This certificate should be given to the retailer. Do not send the completed certificate to the Comptroller of Public Accounts.

1

1 2

2