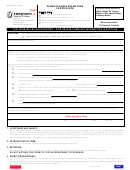

GENERAL INSTRUCTIONS

Those purchasers set forth below may use this form in connection with the claim for exemption for the following taxes:

a.

State and Local Sales and Use Tax;

b.

PTA rental fee or tax on leases of motor vehicles;

c.

Hotel Occupancy Tax if referenced with the symbol (

);

G

d.

PTA fee on the purchase of tires if referenced with the symbol (+);

e.

Vehicle Rental Tax (VRT)

EXEMPTION REASONS

1.) Property and/or services will be used directly and predominately by purchaser in performing purchaser's operation of:

A. Manufacturing

B. Mining

C. Dairying

D. Processing

E. Farming

F. Shipbuilding

This exemption is not valid for property or services which are used in: (a) constructing, repairing, or remodeling of real property, other than real property which

is used directly in exempt operations; or (b) maintenance, managerial, administrative, supervisory, sales, delivery, warehousing or other nonoperational activi-

ties. Effective October 1, 1991, this exemption does not apply to certain services and PTA tire fee.

2.) Purchaser is a/an:

+ A. Instrumentality of the Commonwealth.

+ B. Political subdivision of the Commonwealth.

+

C. Municipal Authority created under the “Municipality Authorities Acts”.

G

+

D. Electric Cooperative Corporations created under the “Electric Cooperative Law of 1990”.

G

E. Cooperative Agricultural Associations required to pay Corporate Net Income Tax under the Cooperative Agricultural Association Corporate Net

G

Income Tax Act (exemption not valid for registered vehicles).

+

F. Credit Unions organized under “Federal Credit Union Act” or Commonwealth “Credit Union Act”.

G

+

G. United States Government, its agencies and instrumentalities.

G

H. Federal employee on official business (Exemption limited to Hotel Occupancy Tax only. A copy of orders or statement from supervisor must be

G

attached to this certificate.)

I. School Bus Operator (This Exemption Certificate is limited to the purchase of parts, repairs or maintenance services upon vehicles licensed as

school buses by the PA Department of Transportation. For purchase of school buses, see NOTE below.)

3.) Property and/or services will be resold or rented in the ordinary course of purchaser's business. If purchaser does not have a PA Sales Tax License Number,

complete Number 7 explaining why such number is not required. This Exemption is valid for property or services to be resold: (1) in original form; or (2) as an

ingredient or component of other property.

4.) Renewable Entities beginning with

Permanent Exemptions beginning with

Special Exemptions:

the two numbers 75:

the two numbers 76:

A. Religious Organization

E. School District

F. Direct Pay Permit Holder

B. Volunteer Firemen's Organization

+

G. Individual Holding Diplomatic ID

G

C. Nonprofit Educational Institution

H. Keystone Opportunity Zone

D. Charitable Organization

I.

Tourist Promotion Agency

Exemption limited to purchase of tangible personal property or services for use and not for sale. The exemption shall not be used by a contractor performing

services to real property. An exempt organization or institution shall have an exemption number assigned by the PA Department of Revenue and diplomats shall

have an identification card assigned by the Federal Government. The exemption for categories “A, B, C and D” are not valid for property used for the following:

(1) construction, improvement, repair or maintenance or any real property, except supplies and materials used for routine repair or maintenance of the real

property; (2) any unrelated activities or operation of a public trade or business; or (3) equipment used to maintain real property.

5.) Property or services will be used directly and predominately by purchaser in the production, delivery, or rendition of public utility services as defined by the PA

Utility Code.

This Exemption is not valid for property or services used for the following: (1) construction, improvement, repair or maintenance of real property, other than real

property which is used directly in rendering the public utility services; or (2) managerial, administrative, supervisor, sales or other nonoperational activities; or

(3) tools and equipment used but not installed in maintenance of facilities or direct use equipment. Tools and equipment used to repair "direct use" property are

exempt from tax.

6.) Vendor/Seller purchasing wrapping supplies and nonreturnable containers used to wrap property which is sold to others.

7.) Other (Attach a separate sheet of paper if more space is required.)

1

1 2

2