Enterprise Zone LIC Instructions, continued

What if I Do Not Use All of My Credit?

Line 3. Enter the total other loan interest income received from

Any unused credit may be carried over to the next eligible tax

nonbusiness loans made for the purposes of rehabilitation,

return to be filed up to 10 years from the date of the loan until

repair, or improvement of a residence or for improvements

all credit has been used or the enterprise zone terminates.

that increase the assessed value of real property located in

any enterprise zone.

Note: A taxpayer is not entitled to a carryback or refund of any

unused credit. The statute does allow the taxpayer to carry

Line 4. Add the amount of business and nonbusiness interest

forward any unused credit.

income and multiply the result by 5%.

What if I Am an Entity Exempt from

Adjusted Gross Income Tax?

Line 5. Indicate the state tax liability you wish to offset by

checking the appropriate tax type box and by entering the

net amount of your state tax liability. Note: The net amount of

Entities exempt from adjusted gross income tax under

tax entered on line 5 must be reduced by all other applicable

IC 6-3-2-2.8(2) may “pass through” the credit to shareholders,

tax liability credits and may not be greater than the amount

partners, beneficiaries, or members of the pass-through entity.

on line 4. Carry the net amount of credit to be used to your

A pass-through entity is an S corporation, a partnership, a trust,

tax type return.

a limited liability company, or a limited liability partnership. Each

member’s tax credit is calculated by multiplying the total credit

Line 6. Subtract line 5 from line 4. The result may not be less

available by the percentage of the entity’s distributive income

than zero. If it's greater than zero, carry the excess unused

to which the shareholder, partner, beneficiary, or member is

amount of credit to Section E.

entitled. The pro rata share of the calculated credit is reported

by the entity on each unit-holder’s Schedule IN K-1. A copy

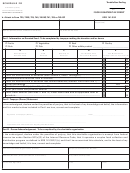

Section E – Enterprise Zone Loan Interest Carryover

of Schedule LIC or IN K-1 must be enclosed with the return

to claim your share of the credit.

Complete this section whenever there is a carryover of unused

loan interest credit. The amount of credit carryover from a

Whom Do I Contact if I Have Questions

taxable year shall be reduced to the extent that the carryover

About t-he Enterprise Zone Loan Interest Credit?

is used by the taxpayer to obtain credit against allowable state

tax liabilities for any subsequent taxable year. Carryover is

Questions concerning enterprise zone income tax

allowed up to 10 years following the date on which a qualified

provisions should be directed to:

loan credit is claimed but not beyond the phase-out period

that terminates the enterprise zone from which a qualified

Indiana Department of Revenue

loan had originated.

Returns Processing Center

Corporate Income Tax Section

Enter in each column the applicable date or amounts for every

PO Box 7206

succeeding taxable year in which a credit carryover is used.

Indianapolis, IN 46207

(317) 232-0129

Section F – Signature

The taxpayer or an authorized agent must sign this

For questions concerning other provisions related

schedule.

to enterprise zones and current locations within the

designated cities, contact:

Where Can I Claim This Credit?

Indiana Economic Development Corporation

The Loan Interest Credit can be applied as a credit against the

One North Capitol, Suite 700

taxpayer’s adjusted gross income tax (IC 6-3-1 through 6-3-7),

Indianapolis, IN 46204

insurance premium tax (IC 27-1-18-2), and financial institution

(317) 232-8800

tax (IC 6-5.5). A copy of Schedule LIC must be enclosed

with the return; otherwise, the credit will be disallowed. The

credit amount calculated on the LIC is to be taken as a credit

against your tax liability on the return in the order listed above

after first applying other credits allowed under IC 6-3.1-1-2.

Refer to Income Tax Information Bulletin #66 for additional

information. Please see the instructions for your tax return to

determine where the credit should be entered on the various

tax forms.

1

1 2

2 3

3 4

4