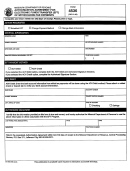

ACH CREDIT OPTION

ACH DEBIT OPTION

To use the ACH Credit option, you must first

To use the ACH Debit option, please complete

contact your bank to determine if your bank

Section A and Section B before returning the form

offers ACH Origination. Please have your bank

to the Electronic Funds Transfer Program Office.

complete the specific portion of the Authorization

After we receive the Authorization Agreement,

Agreement (Form EFT) as verification that your

the State’s service bureau will mail you specific

bank can conform to these standards. Also,

instructions on the initiation of Electronic Funds

please complete Section A and Section C before

Transfer. You authorize each payment amount

returning the form to the Electronic Funds Transfer

to be transferred from your bank account to the

Program Office.

State’s bank by using a toll-free number.

Supplemental filing information must be sent with

After completing the call, the Comptroller of

your payment using the ACH standard CCD+

Maryland is responsible for the successful

format and the TXP addenda record. The Cash

completion of the transaction. The State’s service

Concentration or Disbursement (CCD) is the most

bureau will provide you with a verification code

basic form of ACH payment. The CCD format can

indicating that you have completed the necessary

be processed by all ACH-member banks. The

steps for the initiation of the Electronic Funds

TXP addenda record allows the format to carry

Transfer.

additional characters of payment-related data.

Important characteristics of the ACH Debit

The TXP will be used for tax registration, tax type

transactions are:

code, tax period end date.

It’s easy

Just place a toll-free call to

You will initiate the credit transaction through your

make your tax payment.

bank to the State’s bank account for the amount

of your tax payment.

It’s predictable Only the amount you specify

will be transferred to the

An ACH origination charge from you bank will

State’s bank account on the

be incurred by you if you select the ACH Credit

date specified.

option.

It’s accurate

The

service

bureau

will

Important characteristics of the ACH Credit

provide a verification code as

transactions are:

your proof of payment.

•

Credit transactions require you to enter all

It’s secure

Only

you

will

have

the

payments related data in the standard CCD+

password required to initiate

TXP.

a payment.

It’s flexible

Extensive

editing

and

•

The costs of the ACH Credit transactions are

correction

data

can

be

incurred by you.

performed

before

the

•

You are responsible for your own proof of

transaction is completed. This

payment.

means that transactions are

virtually error free.

It’s inexpensive Cost for an ACH Debit are

primarily borne by the State.

Your bank may have a nominal

fee for processing the debit,

but it is generally the same

cost as a check, or less.

COM/RAD-072 Rev. 10-10

1

1 2

2 3

3