2012

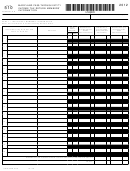

SCHEdULE A - COMPUTATION OF

FORM

510

APPORTIONMENT FACTOR

INSTRUCTIONS

incidental to the individual's service

Pass-through entities (PTEs) that

Maryland. If tangible personal property is

conduct business in more than one state

located in this State for a portion of the

within.

must allocate income if one or more of

tax year, only the income received for

Compensation is also included in the

that portion is included in the numerator.

the members are nonresident individuals

numerator if some part of the service is

or nonresident entities of Maryland.

performed within Maryland and the base of

Capital gains from the sale of real and

Partnerships may use separate accounting

tangible personal property are included

operations or place from which the service

or the apportionment method of alloca tion.

is controlled is in Maryland. If the base of

in the numerator if the property is located

S corporations must use the apportionment

in Maryland. Ordinary net gain or loss

operations or place from which the service

method unless the activity in Maryland is

is controlled is not in any state where the

derived from the sale of depreciable

nonunitary. If the activity within Maryland

assets is excluded from the factor.

service is performed but the individual’s

is nonunitary, S corporations may use

residence is in Maryland, the compensation

Other income items are included in

separate accounting.

is also included in the numerator.

accordance with the provisions previously

APPORTIONMENT FORMULA

OTHER APPORTIONMENT FORMULAS

stated depending on the nature and type

of each item.

NOTE: Double-weighted receipts factor

All factors of the apportionment formula

are developed as fractions, the numerator

provisions are not applicable for PTEs

PROPERTY FACTOR

The property

subject to the following apportionment

of which is the total of Maryland items

factor includes owned as well as rented

and the denominator is the total of items

formulas.

tangible personal property used in the

everywhere during the tax year. Each

trade or business during the tax year.

PTEs engaged primarily in leasing or

factor is calculated to six decimal places

Such properties are inventory, machinery

rental operations must use an equally

and

used

to

arrive

at

the

final

and equipment, buildings and land, and

weighted two-factor formula of receipts

apportionment factor. The items of both

other tangible assets. Property is included

and property. The receipts and property

numerator and denominator should

factors are calculated in accordance with

in the numerator if it has a situs within

reconcile to the items as categorized and

Maryland.

the provisions for those factors of the

reported on the federal income tax return.

three-factor formula, except that receipts

Property owned by the PTE is valued at

from intangible items are excluded.

THREE -FACTOR FORMULA

its original cost at the average of the tax

PTEs engaged primarily in certain

Multistate PTEs using the appor tionment

year beginning and ending amounts. If

method of allocation are gen erally

there are material changes during the tax

types of transportation operations

must use a one-factor formula as follows:

required to use a three-factor formula of

year and the yearly average is not a fair

representation, the average must be

property, payroll and double-weighted

• Trucking operations (motor freight

receipts. The sum of the property factor,

calculated on a monthly or daily basis.

carriers) must use total road mileage

payroll factor and twice the receipts factor

Property in transit is considered to be

traveled in Maryland divided by total

is divided by four to arrive at the final

road mileage traveled everywhere.

at its destination for purposes of the

apportionment formula. To review these

factor. Property under construction during

• Railroad operations must use total

rules, see Maryland Regulation 03.04.03.08.

the tax year is excluded from the factor

track mileage traveled in Maryland

Specific require ments regarding each

until actually placed in service.

divided by total track mileage traveled

factor are set forth as follows:

everywhere.

Property leased or rented by the PTE is

RECEIPTS FACTOR The receipts factor

included in the factor at a capitalized

• Shipping operations must use total

includes the amount of income reported

value. To arrive at the capitalized value,

voyage days in Maryland divided by

during the tax year as gross receipts or

expenses associated with the privilege of

total voyage days everywhere. Voyage

sales (less returns and allowances),

occupying or using the property, including

days are the number of days that ships

dividends, interest, gross rents, royalties,

such items as fixed rent, percentage rent,

spend in ports and on waterways.

capital gains and other income on the

real

estate

taxes,

insurance

and

federal return.

B a n k s

a n d

s i m i l a r

f i n a n c i a l

maintenance, are multiplied by eight.

institutions are subject to special

Gross receipts from sales of tangible

Expenses for gas, electricity, oil, water or

apportionment rules. To review these

personal property are included in the

other items normally consumed are

rules, see Maryland Regulation 03.04.08.

excluded.

numerator if the property is delivered or

shipped to a purchaser that takes

A i r l i n e

o p e r a t i o n s

s h o u l d

s e e

Lease or rental expense below the

possession in Maryland, regardless of

Administrative Release 22 on www.

market rate must be adjusted to reflect

f.o.b. point or other conditions of sale.

for instructions.

a reasonable market rate and then

Sales of tangible personal property to an

capitalized. Sublease income cannot be

Manufacturing

Corporations

are

out-of-state purchaser are also included in

used to arrive at the capitalized value of

subject to a special single-factor formula

the numerator if the purchaser takes

leased or rented property, but must be

based on receipts. The rules for calculating

possession in Maryland. Sales of property

included in the receipts factor.

the single-factor can be found in Maryland

in transit that are destined for Maryland

Regulation 03.04.03.10.

Improvements to the leased or rented

are included in the numerator.

property that revert to the owner at

In addition, S corporations that are

Gross receipts from service-related

expiration of the lease or rental term are

manufacturing corporations with more

activities are included in the numerator

amortized and not capitalized. The actual

than 25 employees, should complete Form

if the receipts are derived from customers

cost of the improvements is divided by

500MC if apportionment is required.

within this State. There are specific rules

the number of years remaining for the

SPECIAL RULES

to determine “Customers Within this

lease or rental term and the result is

State”. To review these rules see Maryland

included in the factor for each tax year.

If the apportionment formula does not

Regulation 03.04.03.08D.

fairly represent the extent of the PTE’s

Property that has remained idle and

Gross income from intangible items

activity within Maryland, the Maryland

has not produced any revenue for a period

Revenue Administration Division may alter

such as dividends, interest, royalties and

of five or more years is not included in

the formula or components accordingly.

capital gains from the sale of intangible

the factor.

property are included in the numerator

The PTE’s share of receipts, property and

PAYROLL FACTOR

All compensation is

based upon the average of the property

payroll of a partnership or joint venture is

to be included in the numerator, both

and payroll factors.

included in the entity’s factors as if they

when the individual’s service is performed

were the direct receipts, property and

Gross receipts from the rental, leasing

entirely within Maryland, and when the

payroll of the entity. The partnership

or licensing of real or tangible

individual’s service is performed both

share is included only to the extent of the

personal property are included in the

within and without Maryland but the

numerator if the property is located in

factors required for the PTE.

service performed outside Maryland is

6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13