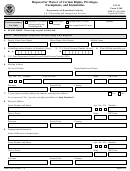

Form 4587 - Michigan Business Tax Schedule Of Recapture Of Certain Business Tax Credits And Deductions - 2012 Page 3

ADVERTISEMENT

Instructions for Form 4587, Michigan Business Tax (MBT)

Schedule of Recapture of Certain Business Tax Credits and Deductions

agreement with MEGA based on qualified new jobs, and then

Purpose

removes 51 percent or more of those qualified new jobs from

Complete this schedule for any recapture in this tax year of

Michigan within three years after the first year in which the

previously claimed tax credits listed on this schedule. Recapture

taxpayer claims such a credit, the taxpayer must recapture an

of some tax credits occurs at the same point in the forms as

amount equal to the total of all such credits claimed on prior

the credit is calculated. The credits on this form, however, are

returns.

required by statute to be recaptured at a later point in the tax

Line 2a: Enter the total amount of the MBT MEGA

calculation process. This form is also used to report a required

Employment Tax Credit claimed on previously filed 4574 forms

recapture of an Affordable Housing Deduction.

subject to recapture.

Attachments in support of these recapture amounts are not

Line 2b: Enter the total amount of the SBT MEGA

required. Maintain the recapture calculation information in

Employment Tax Credit claimed on previously filed SBT

your files for review during audit.

Miscellaneous Credits (Form C‑8000MC) forms subject to

Special Instructions for Unitary Business Groups

recapture.

Line 2c: Enter the total amount of the SBT MEGA Business

If any member of the Unitary Business Group (UBG) is

Activity Credit claimed on previously filed C‑8000MC forms

reporting recapture, a statement must be attached to this

subject to recapture.

form identifying the reporting member and the recapture

information for each applicable credit. If more than one

Line 3: If the new jobs by which a taxpayer earns an

member is reporting recapture, requested information should

Entrepreneurial Credit are relocated outside of Michigan

be provided in the statement on a per member basis. The total

within five years after claiming the credit, or if a taxpayer

amount from all reporting members will be entered on each

reduces employment levels by more than 10 percent of the jobs

corresponding line on this form.

by which the taxpayer earned the credit, the taxpayer must

recapture an amount equal to the total of all Entrepreneurial

Line-by-Line Instructions

Credits received.

Lines not listed are explained on the form.

Enter the total amount of the Entrepreneurial Credit claimed

on previously filed MBT Miscellaneous Nonrefundable Credits

Dates must be in MM-DD-YYYY format.

forms (Form 4573) subject to recapture.

Name and Account Number: Enter name and account number

as reported on page 1 of the applicable MBT annual return

Line 4: Enter the total amount of MEGA Federal Contract

Credit claimed on previously filed MBT Election of Refund

(either the MBT Annual Return (Form 4567) for standard

or Carryforward of Credits forms (Form 4584) subject to

taxpayers, the MBT Annual Return for Financial Institutions

(Form 4590), or the Insurance Company Annual Return for

recapture.

Michigan Business and Retaliatory Taxes (Form 4588)).

NOTE: The MEGA Federal Contract Credit is claimed through

UBGs: A UBG reporting recapture should include only

an agreement with MEGA. If a taxpayer claims this credit and

one copy of this form as part of its annual return. Enter the

subsequently fails to meet requirements of the MBT Act or

Designated Member (DM) name in the Taxpayer Name

conditions of the agreement, the taxpayer must recapture the

field and the DM account number in the Federal Employer

entire amount of such credit previously claimed.

Identification Number (FEIN) field.

Line 5: Enter the total amount of the MEGA Photovoltaic

Technology Credit claimed on previously filed 4574 forms

Line 1: There are two Research and Development Credits in

subject to recapture.

MBT. The one reported on the MBT Credits for Compensation,

Investment, and Research and Development (Form 4570)

Line 6: Enter the total amount of the Biofuel Infrastructure

does not apply here. Report on this line only recapture of the

Credit claimed on previously filed 4573 forms subject to

Research and Development Credit that is certified by Michigan

recapture.

Economic Growth Authority (MEGA) and claimed on MBT

Refundable Credits (Form 4574).

Line 8: The Film Infrastructure Credit is available through an

agreement between the taxpayer and the Michigan Film Office,

The credit is earned under an agreement with MEGA. If

with the concurrence of the State Treasurer. The credit amount

MEGA determines that there has not been compliance with

is up to 25 percent of the base investment expenditures in a

the terms of the agreement, the taxpayer must report recapture.

qualified film and digital media infrastructure project. If the

Enter recapture amount equal to 125 percent of the total of

taxpayer sells or otherwise disposes of a tangible asset that was

all MEGA Research and Development Credits claimed on

paid for or accrued after December 31, 2007, and whose cost

previously filed 4574 forms.

is included in the base investment, the taxpayer must report

recapture equal to 25 percent of the gross proceeds or benefit

Line 2: If a taxpayer claims an MBT or Single Business Tax

from the sale or disposition, adjusted by the apportioned gain

(SBT) MEGA Employment Tax Credit or an SBT MEGA

Business Activity Credit for a previous tax period under an

or loss.

151

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4