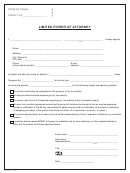

REV184a

Election for Power of Attorney

To have Appointee Receive All Correspondence from the Department of Revenue

You may elect to have the Minnesota Department of Revenue send to your power of attorney any and all refunds,

legal notices, and correspondence relating to your tax matters and to your nontax debts referred to the department

for collection. This election is effective only for the authority you have granted to your appointee. If you make this

election, you will no longer receive anything from the department—including refunds—and your appointee will receive

it all on your behalf.

To make this election, complete and attach this form to the Power of Attorney (Form REV184) granting powers to the

appointee. If Form REV184 is not attached, the department will deny your election, and the form will be returned to

you.

This election will expire on the designated expiration date or when you revoke the power of attorney, whichever is

earlier.

Taxpayer’s name (person or business)

Social Security or MN tax ID number (or federal ID number)

Spouse’s name (if a joint return)

Spouse’s Social Security number (if a joint return)

Street address

Check one

(see instructions):

Original—your first election for this

appointee

City

State

Zip code

Amend—changes an existing election

for this appointee

Expiration date of election

Month

Day

Year

(If a date is not provided, this election is

Cancel/Revoke—cancels a previously

valid until the power of attorney is revoked.)

filed election

I elect to have the Minnesota Department of Revenue directly send to the following attorney-in-fact any and all refunds, legal notices

and correspondence relating to my tax matters and to my nontax debts referred to the department for collection. By making this

election, I understand that I will no longer receive anything—including refunds and legal notices—from the department and my ap-

pointee will receive it all on my behalf.

Name of person (appointee) given power of attorney

Name of firm (if applicable)

Street address

City

State

Zip code

Phone number

FAX number

This election is not valid until the form is signed and dated.

Taxpayer’s signature or signature of corporate officer, partner or fiduciary

Print name (and title, if applicable)

Date

Phone

Spouse’s signature (if joint)

Print spouse’s name (if joint)

Date

Phone

Phone: 651-296-3781 or 1-800-652-9094. TTY: Call 711 for Minnesota Relay

Attach this form to Form REV184 and submit to the Department of Revenue using one of the following methods:

• Attach in a secure email to MNDOR.POA@state.mn.us;

• FAX to 651-556-5210; OR

• Mail to Minnesota Revenue, Mail Station 4123, St. Paul, MN 55146-4123

(Rev. 10/12)

1

1