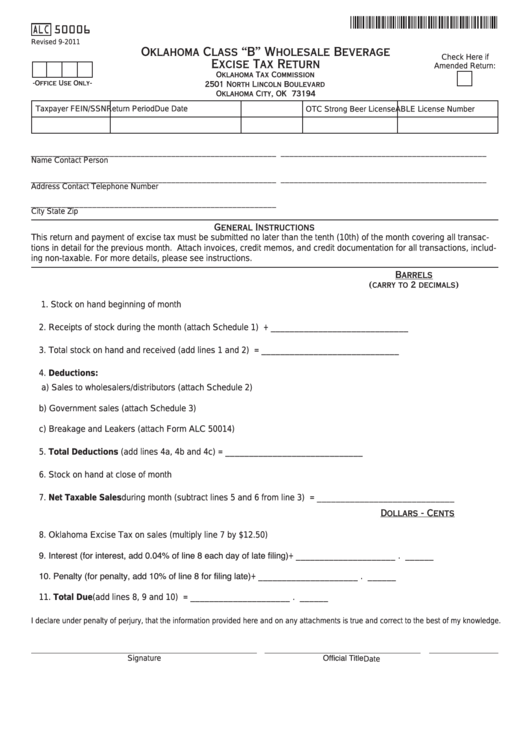

ALC 50006

Revised 9-2011

Oklahoma Class “B” Wholesale Beverage

Check Here if

Excise Tax Return

Amended Return:

Oklahoma Tax Commission

-Office Use Only-

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

Taxpayer FEIN/SSN

Return Period

Due Date

OTC Strong Beer License

ABLE License Number

________________________________________________________

_______________________________________________

Name

Contact Person

________________________________________________________

_______________________________________________

Address

Contact Telephone Number

________________________________________________________

City

State

Zip

General Instructions

This return and payment of excise tax must be submitted no later than the tenth (10th) of the month covering all transac-

tions in detail for the previous month. Attach invoices, credit memos, and credit documentation for all transactions, includ-

ing non-taxable. For more details, please see instructions.

Barrels

(carry to 2 decimals)

1. Stock on hand beginning of month .............................................................. _____________________________

2. Receipts of stock during the month (attach Schedule 1) .............................+ _____________________________

3. Total stock on hand and received (add lines 1 and 2) . .................................= _____________________________

4. Deductions:

a) Sales to wholesalers/distributors (attach Schedule 2) . .......................... _____________________________

b) Government sales (attach Schedule 3) ................................................. _____________________________

c) Breakage and Leakers (attach Form ALC 50014) ................................. _____________________________

5. Total Deductions (add lines 4a, 4b and 4c)................................................= _____________________________

6. Stock on hand at close of month . ................................................................. _____________________________

7. Net Taxable Sales during month (subtract lines 5 and 6 from line 3) .........= _____________________________

Dollars - Cents

8. Oklahoma Excise Tax on sales (multiply line 7 by $12.50) ..........................X _____________________ . _ _____

9. Interest (for interest, add 0.04% of line 8 each day of late filing) .................+ _____________________ . _ _____

10. Penalty (for penalty, add 10% of line 8 for filing late) . ..................................+ _____________________ . _ _____

11. Total Due (add lines 8, 9 and 10) ................................................................= _____________________ . _ _____

I declare under penalty of perjury, that the information provided here and on any attachments is true and correct to the best of my knowledge.

Official Title

Signature

Date

1

1 2

2