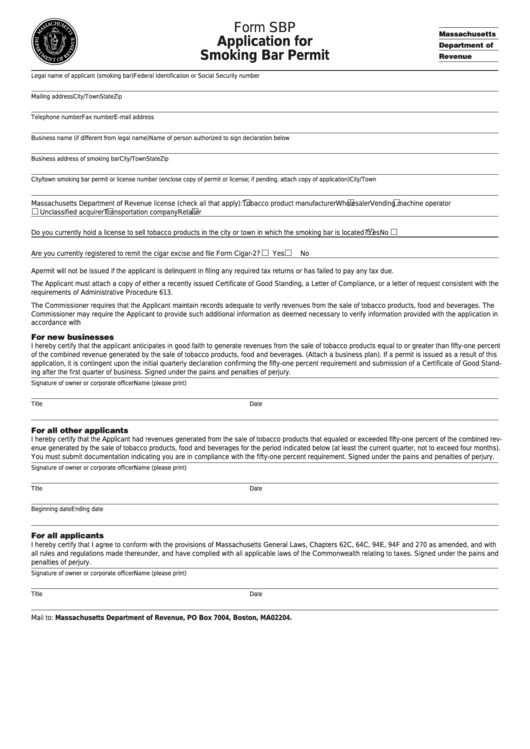

Form Sbp - Application For Smoking Bar Permit

ADVERTISEMENT

2004–2005

Form SBP

Massachusetts

Application for

Department of

Smoking Bar Permit

Revenue

Legal name of applicant (smoking bar)

Federal Identification or Social Security number

Mailing address

City/Town

State

Zip

Telephone number

Fax number

E-mail address

Business name (if different from legal name)

Name of person authorized to sign declaration below

Business address of smoking bar

City/Town

State

Zip

City/town smoking bar permit or license number (enclose copy of permit or license; if pending, attach copy of application)

City/Town

Massachusetts Department of Revenue license (check all that apply):

Tobacco product manufacturer

Wholesaler

Vending machine operator

Unclassified acquirer

Transportation company

Retailer

Do you currently hold a license to sell tobacco products in the city or town in which the smoking bar is located?

Yes

No

Are you currently registered to remit the cigar excise and file Form Cigar-2?

Yes

No

A permit will not be issued if the applicant is delinquent in filing any required tax returns or has failed to pay any tax due.

The Applicant must attach a copy of either a recently issued Certificate of Good Standing, a Letter of Compliance, or a letter of request consistent with the

requirements of Administrative Procedure 613.

The Commissioner requires that the Applicant maintain records adequate to verify revenues from the sale of tobacco products, food and beverages. The

Commissioner may require the Applicant to provide such additional information as deemed necessary to verify information provided with the application in

accordance with M.G.L. c. 270.

For new businesses

I hereby certify that the applicant anticipates in good faith to generate revenues from the sale of tobacco products equal to or greater than fifty-one percent

of the combined revenue generated by the sale of tobacco products, food and beverages. (Attach a business plan). If a permit is issued as a result of this

application, it is contingent upon the initial quarterly declaration confirming the fifty-one percent requirement and submission of a Certificate of Good Stand-

ing after the first quarter of business. Signed under the pains and penalties of perjury.

Signature of owner or corporate officer

Name (please print)

Title

Date

For all other applicants

I hereby certify that the Applicant had revenues generated from the sale of tobacco products that equaled or exceeded fifty-one percent of the combined rev-

enue generated by the sale of tobacco products, food and beverages for the period indicated below (at least the current quarter, not to exceed four months).

You must submit documentation indicating you are in compliance with the fifty-one percent requirement. Signed under the pains and penalties of perjury.

Signature of owner or corporate officer

Name (please print)

Title

Date

Beginning date

Ending date

For all applicants

I hereby certify that I agree to conform with the provisions of Massachusetts General Laws, Chapters 62C, 64C, 94E, 94F and 270 as amended, and with

all rules and regulations made thereunder, and have complied with all applicable laws of the Commonwealth relating to taxes. Signed under the pains and

penalties of perjury.

Signature of owner or corporate officer

Name (please print)

Title

Date

Mail to: Massachusetts Department of Revenue, PO Box 7004, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1