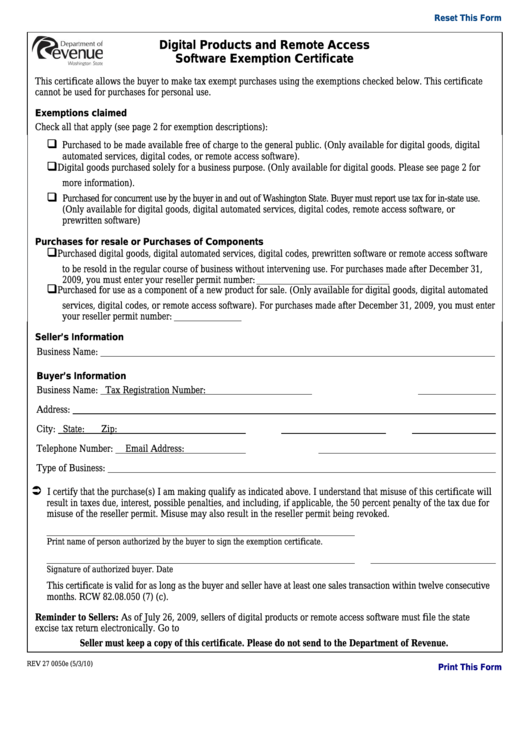

Reset This Form

Digital Products and Remote Access

Software Exemption Certificate

This certificate allows the buyer to make tax exempt purchases using the exemptions checked below. This certificate

cannot be used for purchases for personal use.

Exemptions claimed

Check all that apply (see page 2 for exemption descriptions):

Purchased to be made available free of charge to the general public. (Only available for digital goods, digital

automated services, digital codes, or remote access software).

Digital goods purchased solely for a business purpose. (Only available for digital goods. Please see page 2 for

more information).

Purchased for concurrent use by the buyer in and out of Washington State. Buyer must report use tax for in-state use.

(Only available for digital goods, digital automated services, digital codes, remote access software, or

prewritten software)

Purchases for resale or Purchases of Components

Purchased digital goods, digital automated services, digital codes, prewritten software or remote access software

to be resold in the regular course of business without intervening use. For purchases made after December 31,

2009, you must enter your reseller permit number:

Purchased for use as a component of a new product for sale. (Only available for digital goods, digital automated

services, digital codes, or remote access software). For purchases made after December 31, 2009, you must enter

your reseller permit number:

Seller’s Information

Business Name:

Buyer’s Information

Business Name:

Tax Registration Number:

Address:

City:

State:

Zip:

Telephone Number:

Email Address:

Type of Business:

I certify that the purchase(s) I am making qualify as indicated above. I understand that misuse of this certificate will

result in taxes due, interest, possible penalties, and including, if applicable, the 50 percent penalty of the tax due for

misuse of the reseller permit. Misuse may also result in the reseller permit being revoked.

Print name of person authorized by the buyer to sign the exemption certificate.

Signature of authorized buyer.

Date

This certificate is valid for as long as the buyer and seller have at least one sales transaction within twelve consecutive

months. RCW 82.08.050 (7) (c).

Reminder to Sellers: As of July 26, 2009, sellers of digital products or remote access software must file the state

excise tax return electronically. Go to dor.wa.gov to file online.

Seller must keep a copy of this certificate. Please do not send to the Department of Revenue.

REV 27 0050e (5/3/10)

Print This Form

1

1 2

2