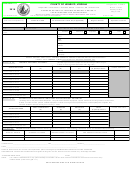

OPTIONAL: FOR USE BY A DESIGNATING BODY WHO ELECTS TO REVIEW THE COMPLIANCE WITH STATEMENT OF BENEFITS (FORM CF-1)

THAT WAS APPROVED AFTER JUNE 30, 1991.

INSTRUCTIONS: (IC 6-1.1-12-5.9)

This page does not apply to a Statement of Benefits filed before July 1, 1991; that deduction may not be terminated for a failure to comply with the Statement

1.

of Benefits.

2.

Within forty-five (45) days after receipt of this form, the designating body may determine whether or not the property owner has substantially complied with

the Statement of Benefits.

If the property owner is found NOT to be in substantial compliance, the designating body shall send the property owner written notice. The notice must include

3.

the reasons for the determination and the date, time and place of a hearing to be conducted by the designating body. If a notice is mailed to a property owner,

a copy of the written notice will be sent to the Township Assessor and the County Auditor.

4.

Based on the information presented at the hearing, the designating body shall determine whether or not the property owner has made reasonable effort to

substantially comply with the Statement of Benefits.

If the designating body determines that the property owner has NOT made reasonable effort to comply, then the designating body shall adopt a resolution

5.

terminating the deduction. The designating body shall immediately mail a certified copy of the resolution to: (1) the property owner; (2) the County Auditor;

and (3) the Township Assessor.

We have reviewed the CF-1 and find that:

the property owner IS in substantial compliance

the property owner IS NOT in substantial compliance

other (specify)

Reasons for the determination (attach additional sheets if necessary)

Signature of authorized member

Date signed (month, day, year)

Attested by:

Designating body

If the property owner is found not to be in substantial compliance, the property owner shall receive the opportunity for a hearing. The following date and

time has been set aside for the purpose of considering compliance.

Time of hearing

Date of hearing (month, day, year)

Location of hearing

AM

PM

HEARING RESULTS (to be completed after the hearing)

Approved

Denied (see instruction 5 above)

Reasons for the determination (attach additional sheets if necessary)

Signature of authorized member

Date signed (month, day, year)

Designating body

Attested by:

APPEAL RIGHTS [IC 6-1.1-12.1-5.9(e)]

A property owner whose deduction is denied by the designating body may appeal the designating body’s decision by filing a complaint in the office of the

Circuit or Superior Court together with a bond conditioned to pay the costs of the appeal if the appeal is determined against the property owner.

1

1 2

2