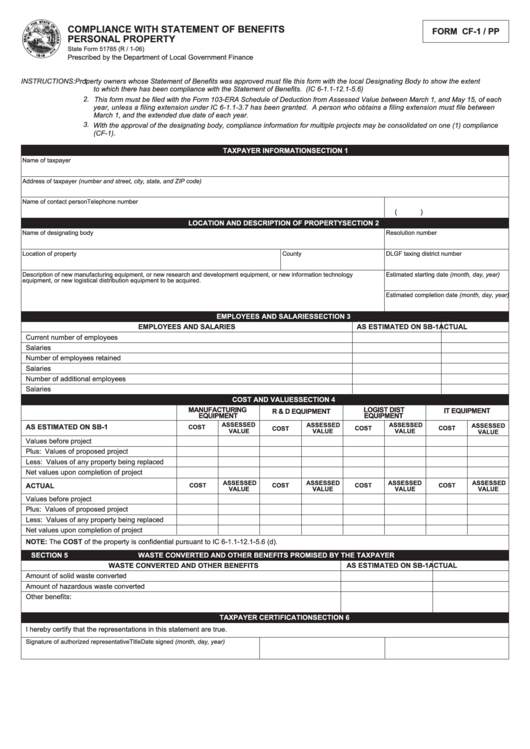

COMPLIANCE WITH STATEMENT OF BENEFITS

FORM CF-1 / PP

PERSONAL PROPERTY

State Form 51765 (R / 1-06)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1.

Property owners whose Statement of Benefits was approved must file this form with the local Designating Body to show the extent

to which there has been compliance with the Statement of Benefits. (IC 6-1.1-12.1-5.6)

2. This form must be filed with the Form 103-ERA Schedule of Deduction from Assessed Value between March 1, and May 15, of each

year, unless a filing extension under IC 6-1.1-3.7 has been granted. A person who obtains a filing extension must file between

March 1, and the extended due date of each year.

3. With the approval of the designating body, compliance information for multiple projects may be consolidated on one (1) compliance

(CF-1).

SECTION 1

TAXPAYER INFORMATION

Name of taxpayer

Address of taxpayer (number and street, city, state, and ZIP code)

Name of contact person

T elephone number

(

)

SECTION 2

LOCATION AND DESCRIPTION OF PROPERTY

Name of designating body

Resolution number

Location of property

County

DLGF taxing district number

Description of new manufacturing equipment, or new research and development equipment, or new information technology

Estimated starting date (month, day, year)

equipment, or new logistical distribution equipment to be acquired.

Estimated completion date (month, day, year)

SECTION 3

EMPLOYEES AND SALARIES

EMPLOYEES AND SALARIES

AS ESTIMATED ON SB-1

ACTUAL

Current number of employees

Salaries

Number of employees retained

Salaries

Number of additional employees

Salaries

SECTION 4

COST AND VALUES

MANUFACTURING

LOGIST DIST

IT EQUIPMENT

R & D EQUIPMENT

EQUIPMENT

EQUIPMENT

ASSESSED

ASSESSED

ASSESSED

ASSESSED

AS ESTIMATED ON SB-1

COST

COST

COST

COST

VALUE

VALUE

VALUE

VALUE

Values before project

Plus: Values of proposed project

Less: Values of any property being replaced

Net values upon completion of project

ASSESSED

ASSESSED

ASSESSED

ASSESSED

ACTUAL

COST

COST

COST

COST

VALUE

VALUE

VALUE

VALUE

Values before project

Plus: Values of proposed project

Less: Values of any property being replaced

Net values upon completion of project

NOTE: The COST of the property is confidential pursuant to IC 6-1.1-12.1-5.6 (d).

SECTION 5

WASTE CONVERTED AND OTHER BENEFITS PROMISED BY THE TAXPAYER

WASTE CONVERTED AND OTHER BENEFITS

AS ESTIMATED ON SB-1

ACTUAL

Amount of solid waste converted

Amount of hazardous waste converted

Other benefits:

SECTION 6

TAXPAYER CERTIFICATION

I hereby certify that the representations in this statement are true.

Signature of authorized representative

Title

Date signed (month, day, year)

1

1 2

2