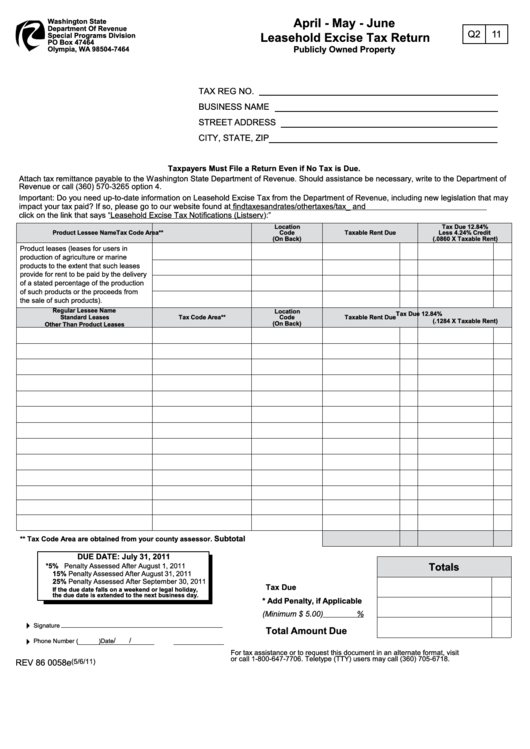

Form Rev 86 - Washington April May June Leasehold Excise Tax Return

ADVERTISEMENT

April - May - June

Washington State

Department Of Revenue

Q2

11

Leasehold Excise Tax Return

Special Programs Division

PO Box 47464

Publicly Owned Property

Olympia, WA 98504-7464

TAX REG NO.

BUSINESS NAME

STREET ADDRESS

CITY, STATE, ZIP

Taxpayers Must File a Return Even if No Tax is Due.

Attach tax remittance payable to the Washington State Department of Revenue. Should assistance be necessary, write to the Department of

Revenue or call (360) 570-3265 option 4.

Important: Do you need up-to-date information on Leasehold Excise Tax from the Department of Revenue, including new legislation that may

impact your tax paid? If so, please go to our website found at and

click on the link that says “Leasehold Excise Tax Notifications (Listserv):”

Location

Tax Due 12.84%

Product Lessee Name

Tax Code Area**

Code

Taxable Rent Due

Less 4.24% Credit

(On Back)

(.0860 X Taxable Rent)

Product leases (leases for users in

production of agriculture or marine

products to the extent that such leases

provide for rent to be paid by the delivery

of a stated percentage of the production

of such products or the proceeds from

the sale of such products).

Regular Lessee Name

Location

Tax Due 12.84%

Standard Leases

Tax Code Area**

Code

Taxable Rent Due

(.1284 X Taxable Rent)

(On Back)

Other Than Product Leases

Subtotal

** Tax Code Area are obtained from your county assessor.

DUE DATE: July 31, 2011

Totals

* 5% Penalty Assessed After August 1, 2011

15% Penalty Assessed After August 31, 2011

25% Penalty Assessed After September 30, 2011

Tax Due

If the due date falls on a weekend or legal holiday,

the due date is extended to the next business day.

* Add Penalty, if Applicable

(Minimum $ 5.00)

%

4

Signature

Total Amount Due

/

/

Phone Number (

)

Date

4

For tax assistance or to request this document in an alternate format, visit

or call 1-800-647-7706. Teletype (TTY) users may call (360) 705-6718.

REV 86 0058e

(5/6/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2