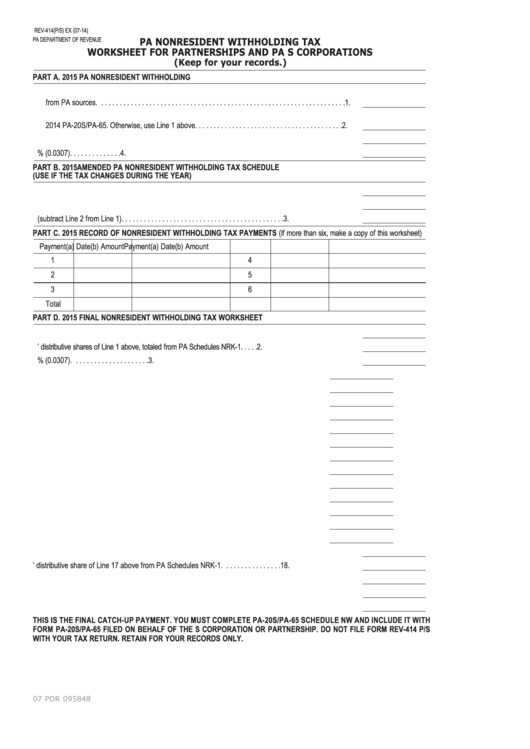

Rev-414 - Pa Nonresident Withholding Tax Worksheet For Partnerships And Pa S Corporations

ADVERTISEMENT

REV-414(P/S) EX (07-14)

PA DEPARTMENT OF REVENUE

PA NONRESIDENT WITHHOLDING TAX

WORKSHEET FOR PARTNERSHIPS AND PA S CORPORATIONS

(Keep for your records.)

PART A. 2015 PA NONRESIDENT WITHHOLDING

1. Enter the 2015 PA-taxable income the partnership or PA S corporation expects to realize

from PA sources. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Enter the 2014 PA-taxable income the entity realized from PA sources and reported on its

2014 PA-20S/PA-65. Otherwise, use Line 1 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Enter the smaller of Line 1 or Line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Nonresident PA-source nonresident withholding. Multiply Line 3 by 3.07% (0.0307). . . . . . . . . . . . . . 4.

PART B. 2015 AMENDED PA NONRESIDENT WITHHOLDING TAX SCHEDULE

(USE IF THE TAX CHANGES DURING THE YEAR)

1. Amended nonresident withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Nonresident withholding payments made to date of amending. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Unpaid balance (subtract Line 2 from Line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

PART C. 2015 RECORD OF NONRESIDENT WITHHOLDING TAX PAYMENTS (If more than six, make a copy of this worksheet)

Payment

(a) Date

(b) Amount

Payment

(a) Date

(b) Amount

1

4

2

5

3

6

Total

PART D. 2015 FINAL NONRESIDENT WITHHOLDING TAX WORKSHEET

1. Enter the total PA-taxable income from PA sources from the 2015 PA-20S/PA-65. . . . . . . . . . . . . . . . 1.

2. Enter the total nonresidents’ distributive shares of Line 1 above, totaled from PA Schedules NRK-1. . . . . 2.

3. Total 2015 PA Nonresident Withholding. Multiply Line 2 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . 3.

4. Allowable PA Employment Incentive Payments Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Allowable PA Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Allowable PA Research and Development Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Allowable PA Film Production Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Allowable PA Keystone Innovation Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Allowable PA Resource Enhancement and Protection Tax Credit. . . . . . . . . . . . . . . . . . . . . 9.

10. Allowable PA Neighborhood Assistance Program Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Allowable PA Strategic Development Area Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . 11.

12. Allowable PA Educational Improvement Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Allowable PA Keystone Special Development Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . 13.

14. Allowable PA Historic Preservation Incentive Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Allowable PA Community-Based Services Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Other PA Schedule OC Credits not listed above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Total Allowable Credits. Add Lines 4 through 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. The nonresidents’ distributive share of Line 17 above from PA Schedules NRK-1. . . . . . . . . . . . . . . . 18.

19. Total nonresident withholding paid for the taxable year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Total credits and withholding payments. Add Lines 17 and 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. Nonresident withholding due. Subtract Line 20 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.

THIS IS THE FINAL CATCH-UP PAYMENT. YOU MUST COMPLETE PA-20S/PA-65 SCHEDULE NW AND INCLUDE IT WITH

FORM PA-20S/PA-65 FILED ON BEHALF OF THE S CORPORATION OR PARTNERSHIP. DO NOT FILE FORM REV-414 P/S

WITH YOUR TAX RETURN. RETAIN FOR YOUR RECORDS ONLY.

07 PDR 095848

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2