Instructions For Schedule Ez - Enterprise Zone Tax Credit

ADVERTISEMENT

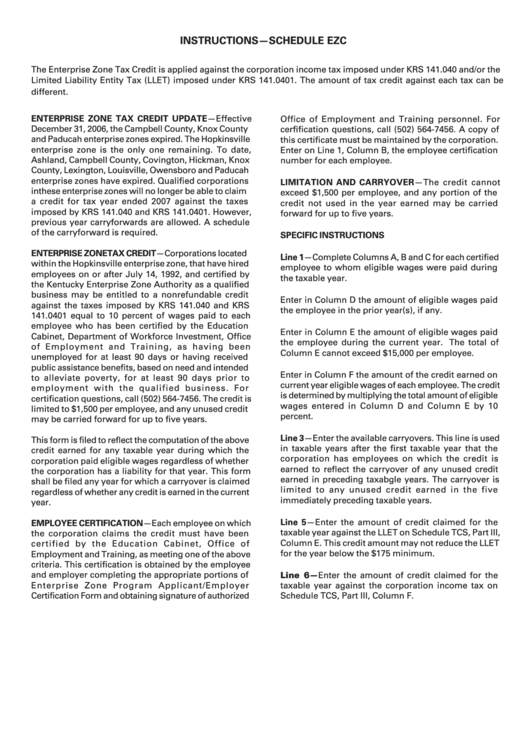

INSTRUCTIONS—SCHEDULE EZC

The Enterprise Zone Tax Credit is applied against the corporation income tax imposed under KRS 141.040 and/or the

Limited Liability Entity Tax (LLET) imposed under KRS 141.0401. The amount of tax credit against each tax can be

different.

ENTERPRISE ZONE TAX CREDIT UPDATE—Effective

Office of Employment and Training personnel. For

December 31, 2006, the Campbell County, Knox County

cerfification questions, call (502) 564-7456. A copy of

and Paducah enterprise zones expired. The Hopkinsville

this certificate must be maintained by the corporation.

enterprise zone is the only one remaining. To date,

Enter on Line 1, Column B, the employee certification

Ashland, Campbell County, Covington, Hickman, Knox

number for each employee.

County, Lexington, Louisville, Owensboro and Paducah

enterprise zones have expired. Qualified corporations

LIMITATION AND CARRYOVER—The credit cannot

in these enterprise zones will no longer be able to claim

exceed $1,500 per employee, and any portion of the

a credit for tax year ended 2007 against the taxes

credit not used in the year earned may be carried

imposed by KRS 141.040 and KRS 141.0401. However,

forward for up to five years.

previous year carryforwards are allowed. A schedule

of the carryforward is required.

SPECIFIC INSTRUCTIONS

ENTERPRISE ZONE TAX CREDIT—Corporations located

Line 1—Complete Columns A, B and C for each certified

within the Hopkinsville enterprise zone, that have hired

employee to whom eligible wages were paid during

employees on or after July 14, 1992, and certified by

the taxable year.

the Kentucky Enterprise Zone Authority as a qualified

business may be entitled to a nonrefundable credit

Enter in Column D the amount of eligible wages paid

against the taxes imposed by KRS 141.040 and KRS

the employee in the prior year(s), if any.

141.0401 equal to 10 percent of wages paid to each

employee who has been certified by the Education

Enter in Column E the amount of eligible wages paid

Cabinet, Department of Workforce Investment, Office

the employee during the current year. The total of

of Employment and Training, as having been

Column E cannot exceed $15,000 per employee.

unemployed for at least 90 days or having received

public assistance benefits, based on need and intended

Enter in Column F the amount of the credit earned on

to alleviate poverty, for at least 90 days prior to

current year eligible wages of each employee. The credit

employment with the qualified business. For

is determined by multiplying the total amount of eligible

certification questions, call (502) 564-7456. The credit is

wages entered in Column D and Column E by 10

limited to $1,500 per employee, and any unused credit

percent.

may be carried forward for up to five years.

Line 3—Enter the available carryovers. This line is used

This form is filed to reflect the computation of the above

in taxable years after the first taxable year that the

credit earned for any taxable year during which the

corporation has employees on which the credit is

corporation paid eligible wages regardless of whether

earned to reflect the carryover of any unused credit

the corporation has a liability for that year. This form

earned in preceding taxabgle years. The carryover is

shall be filed any year for which a carryover is claimed

limited to any unused credit earned in the five

regardless of whether any credit is earned in the current

immediately preceding taxable years.

year.

Line 5—Enter the amount of credit claimed for the

EMPLOYEE CERTIFICATION—Each employee on which

taxable year against the LLET on Schedule TCS, Part III,

the corporation claims the credit must have been

Column E. This credit amount may not reduce the LLET

certified by the Education Cabinet, Office of

for the year below the $175 minimum.

Employment and Training, as meeting one of the above

criteria. This certification is obtained by the employee

and employer completing the appropriate portions of

Line 6—Enter the amount of credit claimed for the

Enterprise Zone Program Applicant/Employer

taxable year against the corporation income tax on

Certification Form and obtaining signature of authorized

Schedule TCS, Part III, Column F .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1