Form Rev-414 - Pa Individuals Worksheet

ADVERTISEMENT

REV-414(I) EX (07-14)

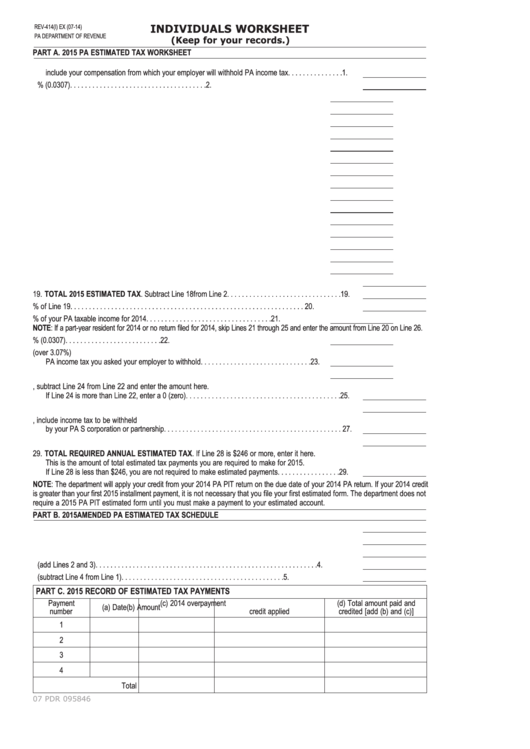

INDIVIDUALS WORKSHEET

PA DEPARTMENT OF REVENUE

(Keep for your records.)

PART A. 2015 PA ESTIMATED TAX WORKSHEET

1. Enter the amount of Pennsylvania taxable income you expect in 2015. Do not

include your compensation from which your employer will withhold PA income tax. . . . . . . . . . . . . . . 1.

2. Tax. Multiply the amount on Line 1 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Estimated 2015 credit for income tax to be paid to other states. . . . . . . . . . . . . . . . . . . . . . 3.

4. Estimated 2015 PA Employment Incentive Payment Tax Credit. . . . . . . . . . . . . . . . . . . . . . 4.

5. Estimated 2015 PA Job Creation Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Estimated 2015 PA Research and Development Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Estimated 2015 PA Film Production Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Estimated 2015 PA Keystone Innovation Zone Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Estimated 2015 PA Resource Enhancement and Protection Tax Credit. . . . . . . . . . . . . . . . 9.

10. Estimated 2015 PA Neighborhood Assistance Program Tax Credit. . . . . . . . . . . . . . . . . . . 10.

11. Estimated 2015 PA Strategic Development Area Job Creation Tax Credit. . . . . . . . . . . . . . 11.

12. Estimated 2015 PA Educational Improvement Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Estimated 2015 PA Keystone Special Development Zone Tax Credit. . . . . . . . . . . . . . . . . . 13.

14. Estimated 2015 PA Historic Preservation Incentive Tax Credit. . . . . . . . . . . . . . . . . . . . . . . 14.

15. Estimated 2015 Community-Based Services Tax Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Other 2015 PA Schedule OC Credits not listed above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Estimated 2015 Special Tax Forgiveness Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. Add Lines 3 through 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

19. TOTAL 2015 ESTIMATED TAX. Subtract Line 18 from Line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Enter 90% of Line 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. Enter 100% of your PA taxable income for 2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.

NOTE: If a part-year resident for 2014 or no return filed for 2014, skip Lines 21 through 25 and enter the amount from Line 20 on Line 26.

22. Figure your tax by multiplying Line 21 by 3.07% (0.0307). . . . . . . . . . . . . . . . . . . . . . . . . . 22.

23. Enter the amount of your expected 2015 withholdings including excess (over 3.07%)

PA income tax you asked your employer to withhold. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

24. Add Lines 18 and 23. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

25. If Line 24 is less than Line 22, subtract Line 24 from Line 22 and enter the amount here.

If Line 24 is more than Line 22, enter a 0 (zero). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.

26. Enter the smaller of Line 20 or 25. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.

27. If you are a non-PA resident, include income tax to be withheld

by your PA S corporation or partnership. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.

28. Subtract Line 27 from Line 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.

29. TOTAL REQUIRED ANNUAL ESTIMATED TAX. If Line 28 is $246 or more, enter it here.

This is the amount of total estimated tax payments you are required to make for 2015.

If Line 28 is less than $246, you are not required to make estimated payments. . . . . . . . . . . . . . . . . 29.

NOTE: The department will apply your credit from your 2014 PA PIT return on the due date of your 2014 PA return. If your 2014 credit

is greater than your first 2015 installment payment, it is not necessary that you file your first estimated form. The department does not

require a 2015 PA PIT estimated form until you must make a payment to your estimated account.

PART B. 2015 AMENDED PA ESTIMATED TAX SCHEDULE

1. Amended estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Amount of 2014 overpayment applied to 2015 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Estimated tax payments you made to date. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Total (add Lines 2 and 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Unpaid balance (subtract Line 4 from Line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

PART C. 2015 RECORD OF ESTIMATED TAX PAYMENTS

Payment

(c) 2014 overpayment

(d) Total amount paid and

(a) Date

(b) Amount

number

credit applied

credited [add (b) and (c)]

1

2

3

4

Total

07 PDR 095846

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2