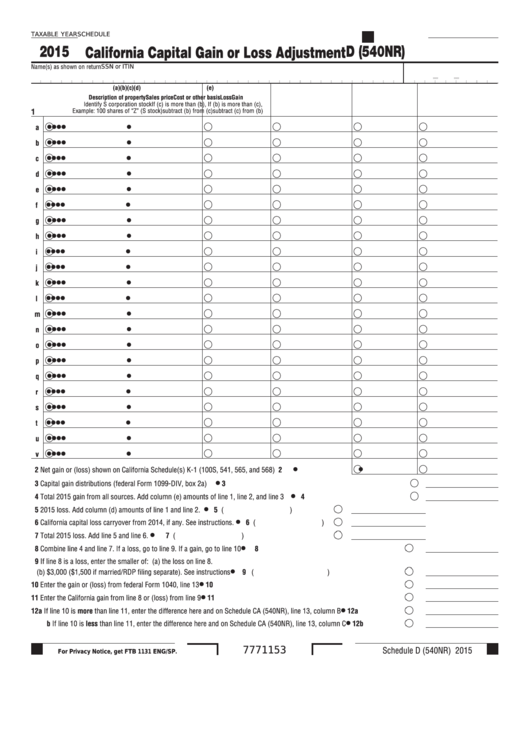

SCHEDULE

TAXABLE YEAR

2015 California Capital Gain or Loss Adjustment

D (540NR)

Name(s) as shown on return

SSN or ITIN

(a)

(b)

(c)

(d)

(e)

Description of property

Sales price

Cost or other basis

Loss

Gain

Identify S corporation stock

If (c) is more than (b),

If (b) is more than (c),

1

Example: 100 shares of “Z” (S stock)

subtract (b) from (c)

subtract (c) from (b)

a

b

c

d

e

f

g

h

i

j

k

l

m

n

o

p

q

r

s

t

u

v

2

Net gain or (loss) shown on California Schedule(s) K-1 (100S, 541, 565, and 568) . . . . . . . . . . . . . . 2

3

Capital gain distributions (federal Form 1099-DIV, box 2a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Total 2015 gain from all sources . Add column (e) amounts of line 1, line 2, and line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

2015 loss . Add column (d) amounts of line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 (

)

6

California capital loss carryover from 2014, if any . See instructions . . . . . . . . . . . . . . . . . . . . . . . . .

6 (

)

7

Total 2015 loss . Add line 5 and line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 (

)

8

Combine line 4 and line 7 . If a loss, go to line 9 . If a gain, go to line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

If line 8 is a loss, enter the smaller of: (a) the loss on line 8 .

(b) $3,000 ($1,500 if married/RDP filing separate) . See instructions . . . . . . . . . . . . .

9 (

)

10

Enter the gain or (loss) from federal Form 1040, line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Enter the California gain from line 8 or (loss) from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

a If line 10 is more than line 11, enter the difference here and on Schedule CA (540NR), line 13, column B . . . . . . . . . . . .

12a

b If line 10 is less than line 11, enter the difference here and on Schedule CA (540NR), line 13, column C . . . . . . . . . . . . .

12b

Schedule D (540NR) 2015

7771153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4