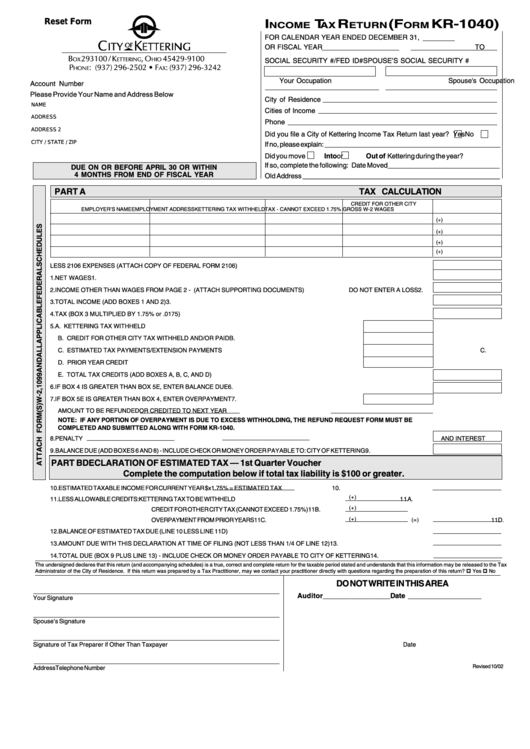

Form Kr-1040 - Income Tax Return

Download a blank fillable Form Kr-1040 - Income Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Kr-1040 - Income Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

I

T

R

(F

KR-1040)

NCOME

AX

ETURN

ORM

FOR CALENDAR YEAR ENDED DECEMBER 31,

OR FISCAL YEAR

TO

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

SOCIAL SECURITY #/FED ID#

SPOUSE’S SOCIAL SECURITY #

P

: (937) 296-2502 • F

: (937) 296-3242

HONE

AX

Your Occupation

Spouse's Occupation

Account Number

Please Provide Your Name and Address Below

City of Residence

NAME

Cities of Income

ADDRESS

Phone

ADDRESS 2

Did you file a City of Kettering Income Tax Return last year?

Yes

No

CITY / STATE / ZIP

If no, please explain: ______________________________________________

Did you move

Into or

Out of Kettering during the year?

If so, complete the following: Date Moved_____________________________

DUE ON OR BEFORE APRIL 30 OR WITHIN

4 MONTHS FROM END OF FISCAL YEAR

Old Address ___________________________________________________

PART A

TAX CALCULATION

CREDIT FOR OTHER CITY

EMPLOYER’S NAME

EMPLOYMENT ADDRESS

KETTERING TAX WITHHELD

TAX - CANNOT EXCEED 1.75%

GROSS W-2 WAGES

(+)

(+)

(+)

(+)

LESS 2106 EXPENSES (ATTACH COPY OF FEDERAL FORM 2106)

(-)

1. NET WAGES

1.

2. INCOME OTHER THAN WAGES FROM PAGE 2 - (ATTACH SUPPORTING DOCUMENTS)

DO NOT ENTER A LOSS 2.

3. TOTAL INCOME (ADD BOXES 1 AND 2)

3.

4. TAX (BOX 3 MULTIPLIED BY 1.75% or .0175)

4.

5. A. KETTERING TAX WITHHELD

5A.

B. CREDIT FOR OTHER CITY TAX WITHHELD AND/OR PAID

B.

C. ESTIMATED TAX PAYMENTS/EXTENSION PAYMENTS

C.

D. PRIOR YEAR CREDIT

D.

E. TOTAL TAX CREDITS (ADD BOXES A, B, C, AND D)

5E.

6. IF BOX 4 IS GREATER THAN BOX 5E, ENTER BALANCE DUE

6.

7. IF BOX 5E IS GREATER THAN BOX 4, ENTER OVERPAYMENT

7.

AMOUNT TO BE REFUNDED

OR CREDITED TO NEXT YEAR

NOTE: IF ANY PORTION OF OVERPAYMENT IS DUE TO EXCESS WITHHOLDING, THE REFUND REQUEST FORM MUST BE

COMPLETED AND SUBMITTED ALONG WITH FORM KR-1040.

8. PENALTY

AND INTEREST

8.

9. BALANCE DUE (ADD BOXES 6 AND 8) - INCLUDE CHECK OR MONEY ORDER PAYABLE TO: CITY OF KETTERING

9.

PART B

DECLARATION OF ESTIMATED TAX — 1st Quarter Voucher

Complete the computation below if total tax liability is $100 or greater.

10. ESTIMATED TAXABLE INCOME FOR CURRENT YEAR $

x 1.75% = ESTIMATED TAX

10.

(+)

11. LESS ALLOWABLE CREDITS:

KETTERING TAX TO BE WITHHELD

11A.

(+)

CREDIT FOR OTHER CITY TAX (CANNOT EXCEED 1.75%)

11B.

(+)

OVERPAYMENT FROM PRIOR YEARS

11C.

(=)

11D.

12. BALANCE OF ESTIMATED TAX DUE (LINE 10 LESS LINE 11D)

12.

13. AMOUNT DUE WITH THIS DECLARATION AT TIME OF FILING (NOT LESS THAN 1/4 OF LINE 12)

13.

14. TOTAL DUE (BOX 9 PLUS LINE 13) - INCLUDE CHECK OR MONEY ORDER PAYABLE TO CITY OF KETTERING

14.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and understands that this information may be released to the Tax

Administrator of the City of Residence. If this return was prepared by a Tax Practitioner, may we contact your practitioner directly with questions regarding the preparation of this return?

Yes

No

DO NOT WRITE IN THIS AREA

Auditor_________________

Date ___________________

Your Signature

Date

Spouse’s Signature

Date

Signature of Tax Preparer if Other Than Taxpayer

Date

Revised 10/02

Address

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2