Form Atd40 - Oil & Gas Field Equipment Personal Property-Owned Declaration Schedule For 2009

ADVERTISEMENT

1 of 3

Form ATD40

State of Wyoming,

Page

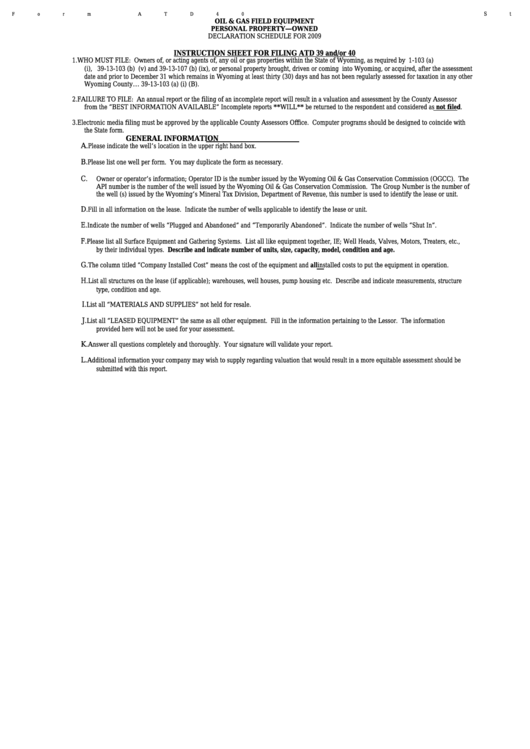

OIL & GAS FIELD EQUIPMENT

PERSONAL PROPERTY—OWNED

DECLARATION SCHEDULE FOR 2009

INSTRUCTION SHEET FOR FILING ATD 39 and/or 40

1. WHO MUST FILE: Owners of, or acting agents of, any oil or gas properties within the State of Wyoming, as required by W.S. 39-11-103 (a)

(i), 39-13-103 (b) (v) and 39-13-107 (b) (ix), or personal property brought, driven or coming into Wyoming, or acquired, after the assessment

date and prior to December 31 which remains in Wyoming at least thirty (30) days and has not been regularly assessed for taxation in any other

Wyoming County… 39-13-103 (a) (i) (B).

2. FAILURE TO FILE: An annual report or the filing of an incomplete report will result in a valuation and assessment by the County Assessor

from the “BEST INFORMATION AVAILABLE” Incomplete reports **WILL** be returned to the respondent and considered as not filed.

3. Electronic media filing must be approved by the applicable County Assessors Office. Computer programs should be designed to coincide with

the State form.

GENERAL INFORMATION

A.

Please indicate the well’s location in the upper right hand box.

B.

Please list one well per form. You may duplicate the form as necessary.

C.

Owner or operator’s information; Operator ID is the number issued by the Wyoming Oil & Gas Conservation Commission (OGCC). The

API number is the number of the well issued by the Wyoming Oil & Gas Conservation Commission. The Group Number is the number of

the well (s) issued by the Wyoming’s Mineral Tax Division, Department of Revenue, this number is used to identify the lease or unit.

D.

Fill in all information on the lease. Indicate the number of wells applicable to identify the lease or unit.

E.

Indicate the number of wells “Plugged and Abandoned” and “Temporarily Abandoned”. Indicate the number of wells “Shut In”.

F.

Please list all Surface Equipment and Gathering Systems. List all like equipment together, IE; Well Heads, Valves, Motors, Treaters, etc.,

by their individual types. Describe and indicate number of units, size, capacity, model, condition and age.

G.

The column titled “Company Installed Cost” means the cost of the equipment and all installed costs to put the equipment in operation.

H.

List all structures on the lease (if applicable); warehouses, well houses, pump housing etc. Describe and indicate measurements, structure

type, condition and age.

I.

List all “MATERIALS AND SUPPLIES” not held for resale.

J.

List all “LEASED EQUIPMENT” the same as all other equipment. Fill in the information pertaining to the Lessor. The information

provided here will not be used for your assessment.

K.

Answer all questions completely and thoroughly. Your signature will validate your report.

L.

Additional information your company may wish to supply regarding valuation that would result in a more equitable assessment should be

submitted with this report.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3