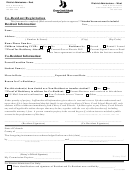

Co Format Form For Japan Page 2

ADVERTISEMENT

OVERLEAF NOTES

1. Japan uses this form for the purpose of preferential tariff treatment under the Agreement on Comprehensive

Economic Partnership among Japan and Member States of the Association of Southeast Asian Nations (AJCEP

Agreement).

2. CONDITIONS: To enjoy preferential tariff treatment under the AJCEP Agreement, goods exported to any Party of the

AJCEP Agreement should:

(i)

fall within a description of goods eligible for concessions in the importing Party;

(ii)

comply with the consignment conditions in accordance with Article 31 of Chapter 3; and

(iii)

comply with the preference criteria provided for in Chapter 3 of the AJCEP Agreement.

3. PREFERENCE CRITERIA: For goods that meet the preference criteria, the exporter or its authorised agent should

indicate in box 6 of this form, the preference criteria met, in the manner shown in the following table:

Circumstances of production or manufacture in the country named in box

Insert in box 6

10 of this form

(a) Goods satisfying subparagraph (c) of Article 24 of Chapter 3

“PE”

(b) Wholly obtained goods satisfying Article 25 of Chapter 3

“WO”

(c) Goods satisfying paragraph 1 of Article 26 of Chapter 3

“CTH” or

“RVC”

(d)

Goods satisfying paragraph 2 of Article 26 of Chapter 3

-

Change in Tariff Classification

“CTC”

-

Regional Value Content

“RVC”

-

Specific Processes

“SP”

Also, exporters should indicate the following where applicable:

(e)

Should goods comply with Article 28 of Chapter 3

“DMI”

(f)

Should goods comply with Article 29 of Chapter 3

“ACU”

4. EACH ITEM SHOULD QUALIFY: All items in a consignment should qualify separately in their own right. This is of

particular relevance when similar items of different sizes are exported.

5. DESCRIPTION OF GOODS: For each good, the HS tariff classification number of the importing Party should be

indicated at the six-digit level. The description of the good on a certificate of origin should be substantially identical to

the description on the invoice and, if possible, to the description under the HS for the good. With respect to

subheading 2208.90 and 9404.90, in an exceptional case where the good is a specific product requiring a special

description (e.g. “sake compound and cooking sake (Mirin) of subheading 2208.90”, “beverages with a basis of fruit,

of an alcoholic strength by volume of less than 1% of subheading 2208.90” “quilts and eiderdowns of 9404.90”), such

description of specific products should be indicated.

6. INVOICES: Indicate the invoice number and date for each item. The invoice should be the one issued for the

importation of the good into the importing Party.

7. THIRD COUNTRY INVOICING: In cases where invoices are issued by a third country, in accordance with Rule 3 (d)

of Implementing Regulations, the “Third Country Invoicing” box in box 9 should be ticked (√) and the number of

invoice issued for the importation of goods into the importing Party should be indicated in box 8, identifying in box 9

the full legal name and address of the company or person that issued the invoice.

In an exceptional case where the invoice issued in a third country is not available at the time of issuance of the

certificate of origin, the invoice number and the date of the invoice issued by the exporter to whom the certificate of

origin is issued should be indicated in box 8. The “Third Country Invoicing” box in box 9 should be ticked (√), and it

should be indicated in box 9 that the goods will be subject to another invoice to be issued in a third country for the

importation into the importing Party, identifying in box 9 the full legal name and address of the company or person

that will issue another invoice in the third country. In such case, the customs authority of the importing Party may

require the importer to provide the invoices and any other relevant documents which confirm the transaction from the

exporting Party to the importing Party, with regard to the goods declared for import.

8. ISSUED RETROACTIVELY: In cases of COs issued retroactively in accordance with Rule 7 of the Implementing

Regulations, the “Issued Retroactively” box in box 9 should be ticked (√).

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2