Hardship Withdrawal Application Form

ADVERTISEMENT

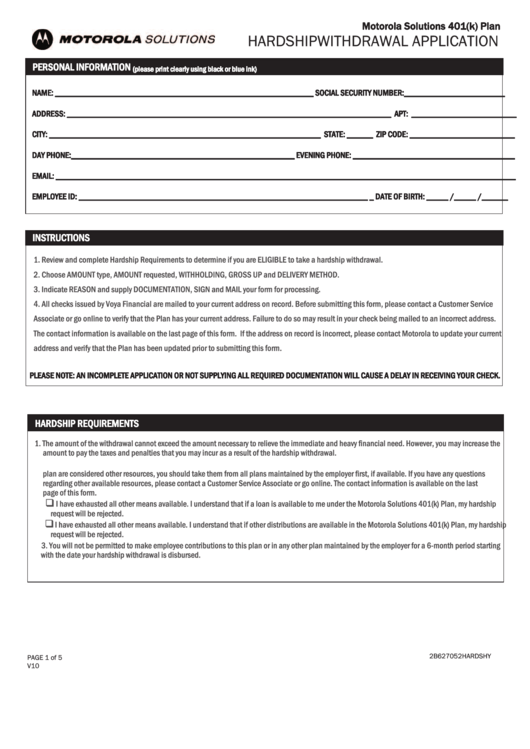

Motorola Solutions 401(k) Plan

HARDSHIP WITHDRAWAL APPLICATION

PERSONAL INFORMATION

(please print clearly using black or blue ink)

NAME: ___________________________________________________________ SOCIAL SECURITY NUMBER:_______________________

ADDRESS: __________________________________________________________________________ APT: ________________________

CITY: ______________________________________________________________ STATE: ______ ZIP CODE: ________________________

DAY PHONE:___________________________________________________ EVENING PHONE: _____________________________________

EMAIL: _________________________________________________________________________________________________________

EMPLOYEE ID: __________________________________________________________________ _ DATE OF BIRTH: _____ /_____ /______

INSTRUCTIONS

1. Review and complete Hardship Requirements to determine if you are ELIGIBLE to take a hardship withdrawal.

2. Choose AMOUNT type, AMOUNT requested, WITHHOLDING, GROSS UP and DELIVERY METHOD.

3. Indicate REASON and supply DOCUMENTATION, SIGN and MAIL your form for processing.

4. All checks issued by Voya Financial are mailed to your current address on record. Before submitting this form, please contact a Customer Service

Associate or go online to verify that the Plan has your current address. Failure to do so may result in your check being mailed to an incorrect address.

The contact information is available on the last page of this form. If the address on record is incorrect, please contact Motorola to update your current

address and verify that the Plan has been updated prior to submitting this form.

PLEASE NOTE: AN INCOMPLETE APPLICATION OR NOT SUPPLYING ALL REQUIRED DOCUMENTATION WILL CAUSE A DELAY IN RECEIVING YOUR CHECK.

HARDSHIP REQUIREMENTS

1. The amount of the withdrawal cannot exceed the amount necessary to relieve the immediate and heavy financial need. However, you may increase the

amount to pay the taxes and penalties that you may incur as a result of the hardship withdrawal.

2. IRS allows hardship withdrawals only when other financial resources are not reasonably available. Since a loan and other distributions from the

plan are considered other resources, you should take them from all plans maintained by the employer first, if available. If you have any questions

regarding other available resources, please contact a Customer Service Associate or go online. The contact information is available on the last

page of this form.

q

I have exhausted all other means available. I understand that if a loan is available to me under the Motorola Solutions 401(k) Plan, my hardship

request will be rejected.

q

I have exhausted all other means available. I understand that if other distributions are available in the Motorola Solutions 401(k) Plan, my hardship

request will be rejected.

3. You will not be permitted to make employee contributions to this plan or in any other plan maintained by the employer for a 6-month period starting

with the date your hardship withdrawal is disbursed.

2B627052HARDSHY

PAGE 1 of 5

V10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5